It’s hard to swallow. In fact most of us would probably choke trying to down over 13 carats of Tiffany’s finest diamonds.

But that, allegedly, is how Jaythan Lawrence Gilder, aged 32, responded when cops in the US finally caught up with him last week.

He swallowed two pairs of earrings that had been stolen a couple of days earlier from the Tiffany & Co store at the Mall of Millenia, in Orlando, Florida, according to an arrest affidavit.

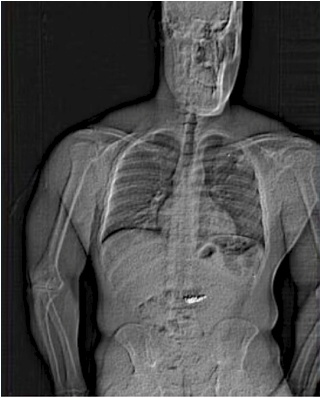

The Orlando Police Department say X-rays taken in custody appear to confirm their suspicions, though at the time of writing they were waiting for nature to take its course.

Gilder allegedly posed as the representative of an Orlando Magic basketball player so that he’d be taken to a private room to view high-value items.

Police said he grabbed a pair of 8.19-carat diamond earrings (valued at $609,500), and a 4.86-carat diamond pair (valued at $160,000) together with a ring valued at $587,000 (no description given).

He then pushed past an employee, according to the arrest affidavit, and escaped in a blue 2024 Mitsubishi Outlander.

Two days later he was apprehended by Florida Highway Patrol troopers who spotted his vehicle. He was arrested on 48 outstanding warrants for other offences, but the officers couldn’t immediately locate the stolen Tiffany jewelry.

While in custody, however, Gilder reportedly asked jail staff whether he was going to be charged with “what’s in my stomach”. A scan revealed “foreign objects” that appeared to be the stolen earrings.

“These foreign objects are suspected to be the Tiffany & Co earrings taken in the robbery but will need to be collected by WCSO (Washington County Sheriff’s Office, Florida) after they are passed through Gilder’s system prior to confirming,” the arrest report states.

It is indeed a bizarre crime, but it is not unique. In fact Joan Hannington, aka The Godmother, perfected the technique of diamond swallowing over a long and notorious criminal career.

It started when she was working in a high-end jewelry store in London in the 1970s. Realizing that the surveillance cameras weren’t working, she took a handful of loose diamonds from the safe on impulse and swallowed them. It later turned out they were worth £800,000.

“Swallowing diamonds was my life, my buzz, my drug,” she later wrote in her memoir I Am What I Am.

For the next 20 years she used the same technique – as described in her second memoir, Joan: The True Story of Britain’s Most Notorious Diamond Thief, and as depicted in the fictionalized 2024 TV series Joan.

She’d visit a jewelry store, posing as a wealthy US tourist, often in a fur coat. She’d flirt outrageously with the salesman, while carefully memorizing her target piece.

She’d later return with a cheap but convincing replica, fake a sneeze as she was viewing the piece for a second time, and swallow the genuine item. She’d then sterilize the stolen gems in a bowl of gin and sell them on to a fence.

Hannington, now aged 68, was sentenced to 30 months for possession of a stolen check book when she was 24,but she says she was never jailed for her diamond swallowing escapades. She does however suffer painful ulcers as a long-term consequence.

Source: John Jeffay IDEX