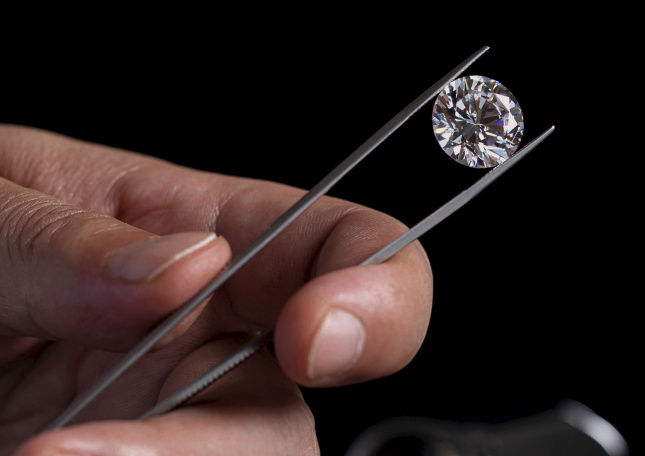

A “toi et moi” ring featuring a 3.61 carat fancy vivid yellow, internally flawless, pear-shaped diamond sold for $254,000 at the Phillips New York Jewels Auction.

It beat its low estimate of $240,000 but fell short of its $300,000 high estimate.

The platinum ring (pictured) set with a 5.03 carat D Color, internally flawless pear-shaped white diamond as well as the yellow diamond and isaccented with brilliant-cut diamonds and similarly cut diamonds of yellow tint.

Overall 70 per cent of lots were sold (by number and by value) raising a total of $2.58m

The auction, on 13 December, featured 146 lots with a strong emphasis on colored diamonds and gemstones, antique-cut diamonds, and signed pieces from renowned makers.

Cristina Rodrigo, specialist and head of sale, jewels, New York, said there was “a great deal of participation from across the globe, leading to strong prices for important pieces spanning style and price points”.

Source: IDEX