Diamond output for De Beers slumped 23 per cent in the first quarter, as production was cut in response to a slow recovery in demand amid a pullback in luxury spending and the proliferation of lab-grown equivalents.

De Beers was the only unit of Anglo American to adjust its full-year production forecast on Tuesday, reducing its guided range to 26mn to 29mn carats of output, from 29mn to 32mn, and lifting expected average costs to $90 per carat, from $80.

Anglo American said the diamond market was suffering from a price rout caused by excess piles of inventory, something that De Beers has previously acknowledged is partly down to lab-grown diamonds cannibalising demand for mined stones.

“Ongoing uncertainty around economic growth prospects has led to a continued cautious purchasing approach” by its customers, Anglo American said. “The recovery in rough diamond demand is expected to be gradual through the rest of the year,” it added.

De Beers said a nascent recovery had begun in the first quarter, buoyed by improved demand for diamond jewellery around Christmas and new year in the US.

Diamond producers including De Beers’ arch-rival, Russia’s Alrosa, tried to curb the flow of gemstones into the market in the second half of last year. The Indian government even put on a voluntary import moratorium on rough stones in the final quarter to protect its polishers and cutters.

Despite those continued efforts into this year, demand, prices and the market recovery remains sluggish, Anglo said, requiring further action to be taken to reduce supply.

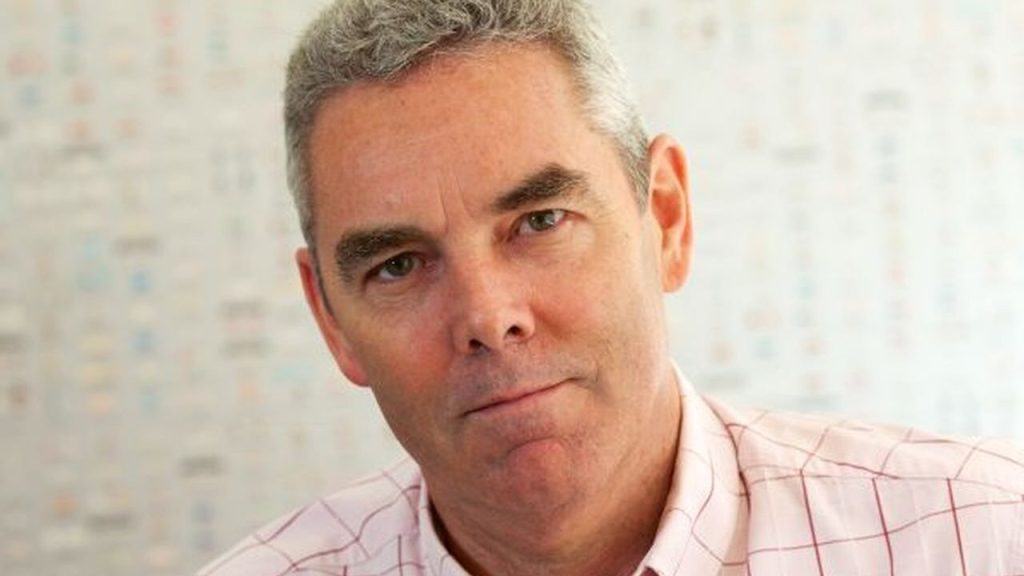

Anglo American chief executive Duncan Wanblad has been under pressure to improve performance since a production downgrade in December sent shares tumbling, although it has been aided by higher commodity prices, especially for copper.

Wanblad has said that “nothing is off the table” when it comes to asset sales or other options to restructure units, of which De Beers and the platinum group metals division are the most troubled.

“We are progressing through our asset review to optimise value by simplifying and improving the overall quality of the portfolio,” he said in a statement in the first-quarter production update on Tuesday.

Shares in Anglo American dropped 1.7 per cent in early trading in London and remain about a third lower than they were at the start of 2023.

Besides diamonds, the London-based company managed to maintain its guidance across its other commodities such as copper, iron ore and steelmaking coal.

Copper output jumped 11 per cent to 198,100 tonnes, helped by record throughput at its Quellaveco mine in Peru and higher grades at its Chilean mines Collahuasi and El Soldado.

South Africa, where Anglo American has iron ore, steelmaking coal and platinum mines, has become an increasing drag on production because of crippling problems in the logistics and power sector. Rail constraints resulted in a 2 per cent drop in output at Kumba Iron Ore.

Source: ft.com