A brazen diamond robbery at Namibia Desert Diamonds (Namdia) early on Saturday evening and involving what is suspected to be the company’s largest-ever consignment of precious stones received, has resulted in two fatalities and two arrests.

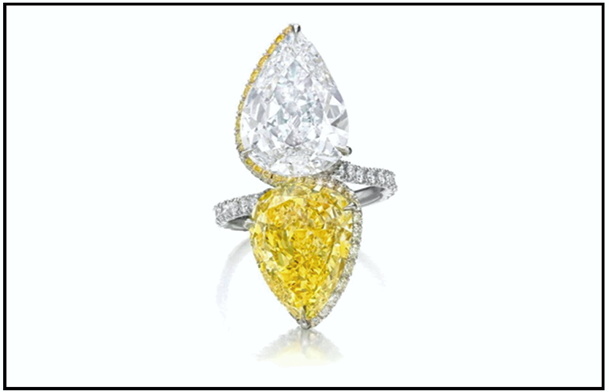

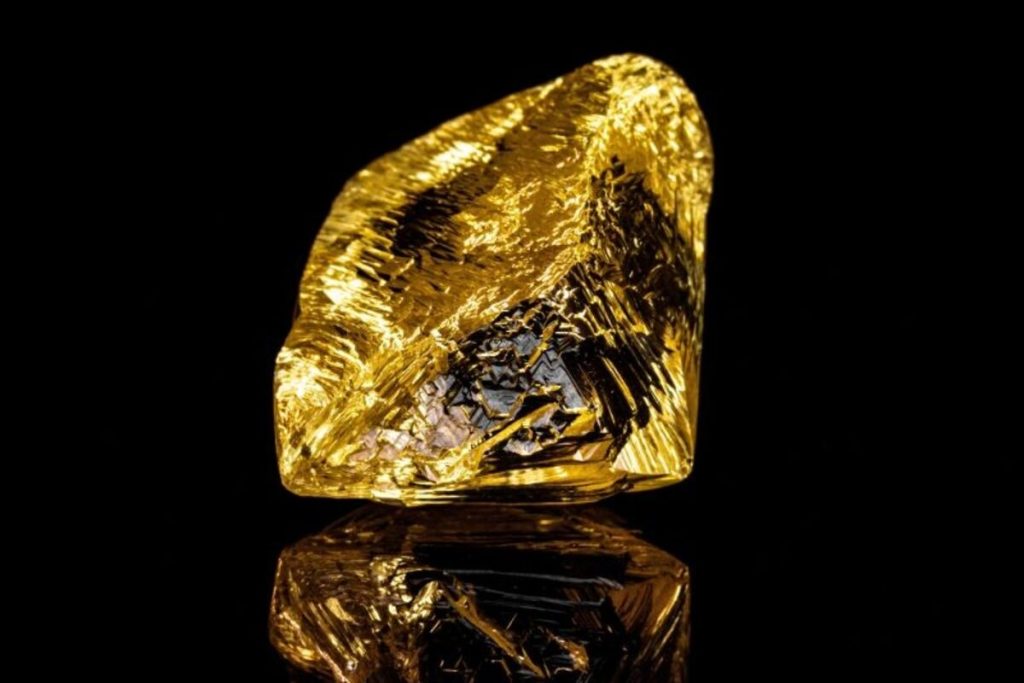

Although the figure could not be independently verified, a person with intricate knowledge of the matter said the diamonds are worth more than US$15 million (about N$280 million).

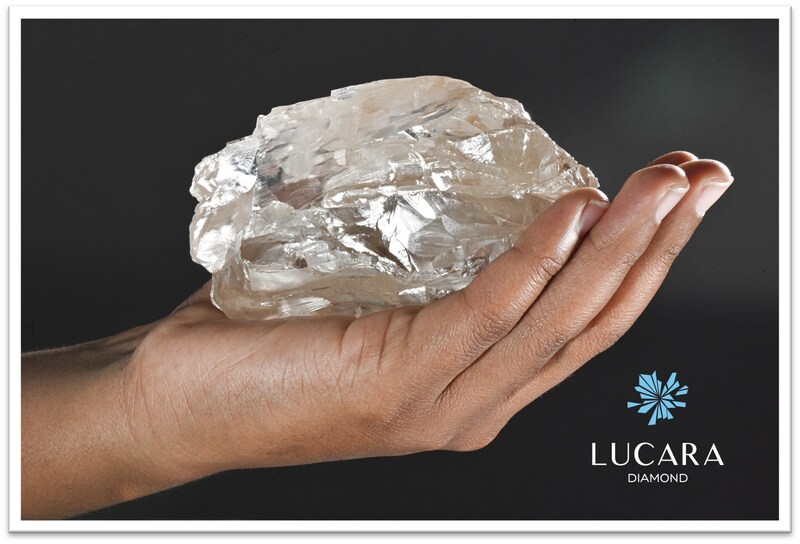

This consignment was reportedly delivered to Namdia’s premises by the Namibia Diamond Trading Company (NDTC). NDTC is a 50:50 joint venture between the government and De Beers Namibia Holdings. It was formally conceived in January 2007 following an agreement to sort, value and market Namibian diamonds.

Responding to questions yesterday, NDTC CEO Brent Eiseb could not provide any details for security reasons.

“For safety and security reasons, NDTC does not provide details of rough diamond deliveries/movements. Kindly refer all incident-related queries to Namdia,” Eiseb said.

The Namibian Police have said the exact amount of diamonds stolen in the robbery is unknown, pending an inventory by Namdia.

“The suspects fled with an unspecified amount of Namdia’s diamonds, whose value

is still to be ascertained. There were four suspects involved in the robbery. Two suspects are currently on the run. One suspect is in police custody. One suspect died from a self-inflicted gunshot wound during the incident,” Alisa Amupolo said in another statement issued late yesterday. According to sources familiar with Namdia’s modus operandi, the company was warned to tighten up its security.

This, however, never happened. “There were several warnings last year that the security left a lot to be desired. The staff has been worried about this. The board chairman [Justus Hausiku] warned Alisa Amupolo [CEO] several times to focus on security,” said the source, who preferred to speak on condition of anonymity.

Despite the advice to improve its security, Namdia’s offices were guarded by a single security guard only identified as Herman, who was seconded from a local security company.

During the heist, Herman was handcuffed, but somehow managed to notify people at neighbouring premises to call the police, claiming “we’re being robbed”.

Execution

The police confirmed the execution-style killing of a Namdia protection officer during the robbery, as well as one of six perpetrators who succumbed to injuries sustained during the theft. “It is with deep sadness that we confirm an attempted armed robbery at our premises earlier today [Saturday], which tragically resulted in the loss of one of our valued staff members. We are cooperating fully with law-enforcement, and a thorough investigation is currently underway. As this is an ongoing investigation, we are working closely with the relevant authorities to establish the facts surrounding the incident. Namdia remains fully committed to ensuring the safety and security of both its staff and diamonds,” Amupolo said.

Crime report

The weekend police crime report issued yesterday stated that the robbery and murder occurred between 17h00 and 18h00 at the Namdia head office in Klein Windhoek. The police say armed suspects broke into the Namdia premises through yet-to-be determined means.

The police further said the robbers held staff hostage by tying them up before stealing an undisclosed amount of diamonds.

“In one of the storerooms, the supervisor, who is a protection officer, was found dead with his hands and legs tied up and his face covered with a shopping bag, and a gunshot wound inflicted to the head. He was identified as Francis Eiseb, a 57-year-old Namibian male. His next of kin have been informed of his death,” the police crime report states.

Police said one of the robbery suspects was found with what appeared to be two gunshot wounds. Late yesterday, police identified Max Endjala as the deceased suspect who was allegedly involved in the Namdia heist. His next of kin have also been informed of his death. He was an auditor at a local firm, according to reports.

Law-enforcement officers at the scene collected four firearms and some knives. The investigation is ongoing, with the police appealing to members of the public who might have any information about the robbery or the suspects to pass it on to the relevant authorities.

Furthermore, sources said staff at Namdia were called in yesterday for interrogation on the robbery, which some people suspect took place based on inside information regarding the amount of diamonds on the premises at the time.

Family ties

State broadcaster NBC also reported that one more arrest had been made in connection with the robbery. The male suspect is employed as a security officer at Namdia and is related to Endjala, the suspect who allegedly shot himself in the head, NBC reported.

Fond memories

In a social media post on Sunday, Namdia’s former CEO Kennedy Hamutenya hailed Eiseb as one of the hardest-working and most committed employees during his time.

Eiseb, he reminisced, would perform above and beyond the call of duty. “He’d even volunteer to drive clients to and from the airport to ensure their safety. He was kind and cordial to all other colleagues, and was full of respect,” Hamutenya’s post reads.

Also taking to his WhatsApp social media platform yesterday was Bryan Eiseb, the Head of the Financial Intelligence Centre and a brother of the late Francis, who said the Eiseb family has “forgiven those who are responsible for Francis’ horrendous death. You [Francis] have paid the ultimate price for Namibia.”

Namdia was founded by the government in 2016 to independently market and sell Namibia’s diamonds on the international market. The Namdia headquarters is considered one of the most secure in Windhoek, considering the value consignments it regularly handles. It is estimated that Namdia annually sells some N$2 billion worth of diamonds on the international market.

Read more: ‘N$280m gems’ stolen in Namdia heist https://neweralive.na/n280m-gems-stolen-in-namdia-heist

Source: Neweralive

_updates.jpg)