Rare ‘Mellon Blue’ Diamond Fetches $25.5 Million at Christie’s Geneva Market Reflects Shifting Demand for Coloured Diamonds

The legendary Mellon Blue Diamond a 9.51-carat fancy vivid blue, internally flawless gem sold for $25.5 million[…]

Legendary 137-Carat Florentine Diamond of the Habsburgs Rediscovered in Canadian Bank Vault After a Century

The world of fine jewellery is abuzz with the remarkable discovery of the legendary “Florentine” diamond a[…]

Sotheby’s Geneva Showcases Exceptional Provenance and Record-Breaking Natural Diamonds

At the forefront of the Sotheby’s High Jewellery Sale is The Glowing Rose, an extraordinary 10.08-carat Fancy[…]

Rockefeller Kashmir Sapphire could Fetch $2.5m

The Rockefeller Kashmir, an Art Deco ring that belonged to the late John D. Rockefeller 3rd and[…]

Five More Arrests over Louvre Heist

Five more suspects were arrested on Wednesday night (29 October) in connection with the Louvre heist.

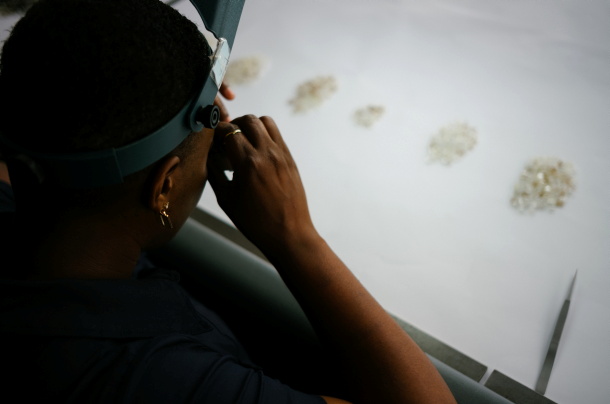

De Beers Rough Sales Triple in Q3

De Beers sold $700m worth of rough diamonds across its two sights in the three months to[…]

Alrosa to Extract Gold as Byproduct of Diamond Mining

Alrosa plans to extract gold from its diamond-bearing alluvial deposits in Mirny, in Russia's Sakha Republic.

Post-Tariff Slump in US Imports of Swiss Watches

Swiss watch exports to the US plunged by more than 55 per cent in September, in what[…]

Napoleon’s Diamond Brooch Leads Sotheby’s Sale

Treasures that once belonged to Napoleon Bonaparte are to be offered for sale by Sotheby's Geneva on[…]

Rare Half-Pink 37.4-Carat Diamond Unearthed in Botswana

A remarkable two-coloured natural diamond has been discovered in Botswana, astonishing experts with its size and formation.[…]