Lucapa’s Lulo Mine Turns Out 160ct. Rough

Lucapa Diamond Company has recovered a 160-carat, high-quality rough from its Lulo mine in Angola, the sixth-largest[…]

Lucapa Sales Surge in Buoyant Market

Lucapa Diamond Company’s revenue rose in the third quarter amid strong demand and an increase in sales[…]

Three +100 carat diamonds recovered at Lucapa’s Lulo mine

Lucapa Diamond Company and its partners Endiama and Rosas & Petalas have announced the recovery of three[…]

Lucapa recovers third 100+ carat diamond for 2021

Lucapa Diamond Company has discovered a 114-carat white diamond from the Lulo alluvial diamond mine in Angola,[…]

Lucapa finds massive white diamond at Mothae

Lucapa Diamond Company has recovered a 215-carat diamond from the Mothae kimberlite mine in Lesotho, Africa. The[…]

Lucapa’s Lulo diamonds fetch US$5.9 million

Lucapa Diamond Company and its partners have announced the results of the first diamond sale of 2021[…]

Bristow to finally put Rockwell Diamonds saga to bed after firm unveils wind-up plan

MARK Bristow, CEO of Barrick Gold Corporation, is to finally close the book on Rockwell Diamonds, a[…]

Lucapa’s run of recovering +100 carat diamonds continues

Lucapa Diamond Company and its partners have announced the recovery of the 18th +100 carat white diamond by[…]

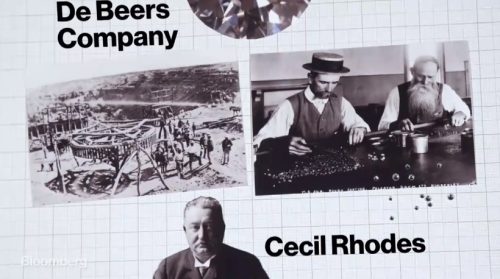

Diamond Trading Goes Online as Lucara Takes on Industry Goliaths

The opaque diamond trade may be ripe for disruption. Lucara Diamond, which recently found the second-largest diamond[…]