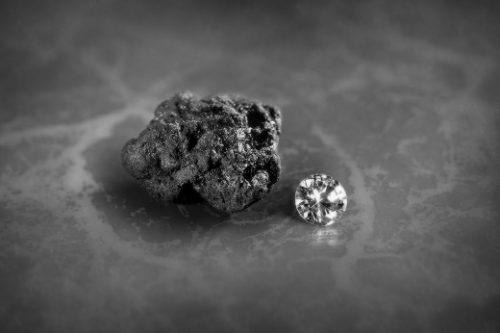

IGI Grades Record Black Lab-Grown Diamond

The International Gemological Institute (IGI) recently graded a 116-carat, black synthetic diamond that ranks as the largest[…]

GIA to Give Full Color, Clarity Grades for Lab-Grown

The Gemological Institute of America (GIA) is launching a new digital report for lab-grown diamonds that will[…]

De Beers Adds Grading Specs for Lightbox

Lightbox has added grading information for its synthetic white diamonds in an effort by the De Beers[…]

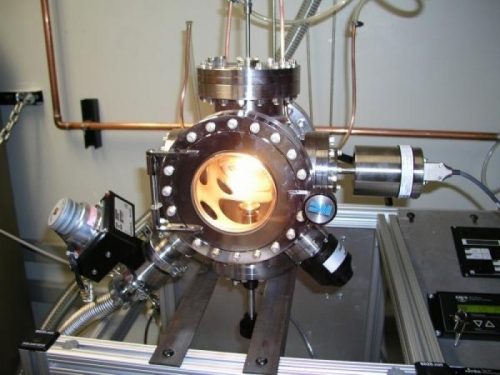

De Beers Scores Partial CVD Patent Victory

A court has awarded a limited victory to De Beers’ synthetic-diamond production unit in a patent dispute[…]

WD Sues Diamond Growers over CVD Patents

The companies behind WD Lab Grown Diamonds have filed three lawsuits against competitors, accusing them of infringing[…]

De Beers Issues Synthetics Guidelines

De Beers has provided its rough-diamond clients and Forevermark partners with guidelines on how to operate in[…]

FTC Drops ‘Natural’ From Definition of Diamond, A Win for Lab-Grown Producers

laboratory grown diamond producers