The European Union on Wednesday imposed sanctions on Russia’s state-run diamond giant Alrosa and its CEO as part of a ban on imports of the precious stones over the Ukraine war.

The EU in December agreed to prohibit diamonds exported from Russia as it tightens sanctions to further sap the Kremlin’s coffers.

The 27-nation bloc added Alrosa, the world’s largest diamond mining company, and its chief executive Pavel Marinychev to a blacklist subject to a visa ban and asset freeze in the EU.

The EU said the company — which accounts for 90% of Russia’s diamond production — “constitutes an important part of an economic sector that is providing substantial revenue to the government.”

Russia’s diamond exports totaled around $4 billion in 2022.

The EU’s ban went into force on Jan. 1, targeting natural and synthetic diamonds exported from Russia.

A prohibition on Russian diamonds processed in third countries will be phased in by September.

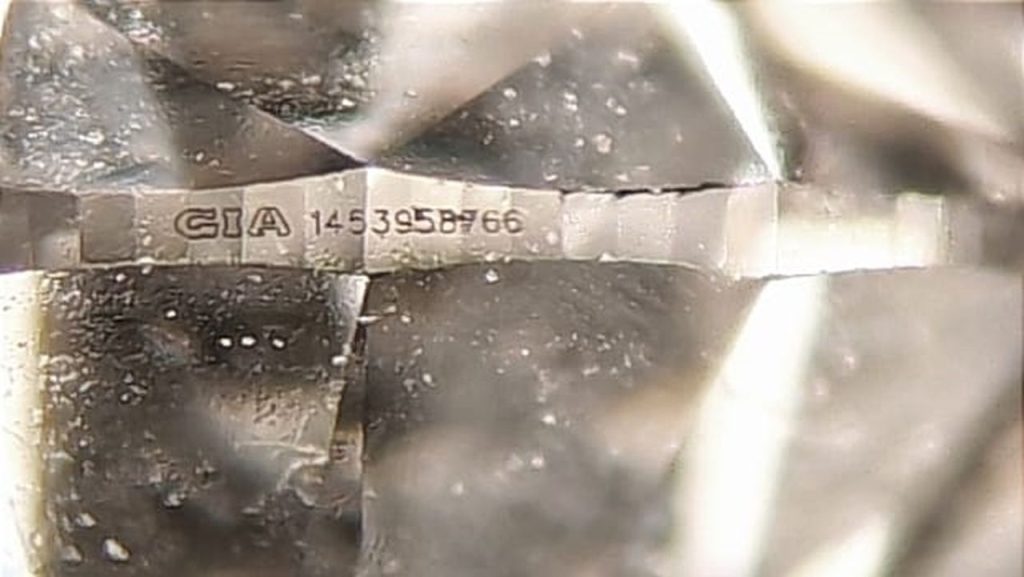

The EU ban came after months of painstaking negotiations with G7 countries to set up a system to trace Russian diamonds.

Belgium, which is home to the world’s largest diamond trading hub, insisted the system needed to be put in place to make any embargo effective.

The EU has so far imposed 12 rounds of sanctions on Moscow since Russian President Vladimir Putin launched the full-scale invasion of Ukraine in February 2022.

Source: themoscowtimes