Assessing the value of a diamond is a job that’s been done by eye for centuries.

But artificial intelligence (AI) is now so sophisticated that it can do the same task faster, cheaper and more accurately.

There can be a huge difference in value even between two diamonds of the same size. That’s why a whole industry has developed, dedicated to grading them.

But advances in machine learning have now made computers more reliable than humans, according to Sarine, a diamond-tech company based in Israel.

Today the vast majority of diamond manufacturers – the businesses that cut and polish rough gems – send their loose stones to grading labs.

They wait a couple of weeks for the diamonds to be returned with certificates listing their key attributes. And they typically pay at least $100 per diamond for the service (depending on size).

Sarine aims to dramatically cuts cost and delays by locating its automated eGrading technology inside factories in a lease arrangement.

Staff operate the machine, which can grade and certify a diamond in a matter of minutes.

More on Innovation

It’s as convenient as using an ATM, says Roni Ben-Ari, deputy CEO & VP products at Sarine.

He says the machines consistently deliver higher quality results than the best grading labs, without the expense of employing gemologists (gemstone experts) or paying for premises, infrastructure and other overheads.

Can’t cheat the system

You may be thinking the diamond factory gets to “mark its own homework” if the grading machine is inhouse, and that it could cheat the system to get a better grade.

But Ben-Ari is adamant that the system’s security is so tight it’s simply not possible for anyone to interfere.

Every diamond is unique – like a fingerprint, a snowflake or DNA – and every diamond is identified by full 360-degree images.

The raw data that Sarine’s machines gather is securely uploaded to the cloud, and only then converted into a grading report.

It’s worth considering what’s at stake here.

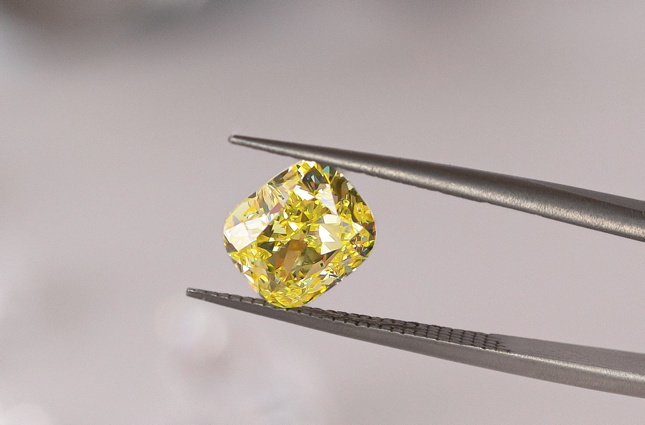

An absolute top-quality natural one-carat diamond (a popular size for engagement rings) could set you back $14,000. But you could get a poor-quality diamond of the same size for under $2,000. That’s why grading a diamond is so important.

The 4Cs

Four main criteria determine the value of a diamond. They’re known as the 4Cs – carat (weight), cut (how well the rough stone has been shaped), color (the best diamonds are colorless) and clarity (absence of flaws or blemishes).

Color and clarity are the hardest criteria to determine. Labs give diamonds a letter for color (from D to Z) and a label indicating one of 11 levels of clarity (from IF, internally flawless, to I3 for diamonds with the worst flaws or “inclusions”).

Weighing a diamond is straightforward, but the other three Cs can be subjective.

“I can guesstimate that if you sent the same 100 diamonds to the lab over and over again, around 70 percent would get the same grade,” says Ben-Ari.

That leaves 30% where a different lab, or a different day, or a different staff member could give the diamond a different grade – and a different value.

A lot of biases

“The human eye is a muscle; it gets tired,” says Ben-Ari. “It’s affected by your physical conditions, whether you’re tired or angry, or it’s the beginning of the shift or the second half of the shift.

“There are a lot of biases. It’s very difficult to educate people from different cultures in different locations around the world to grade the same diamond in the same way.

“So the labs invented a very sophisticated process where two people grade the diamond. When they agree, that’s the diamond grade and when they don’t, they bring in a third person.”

But it’s a labor-intensive business. Sarine, already an established world leader in guiding diamond cutters to get the highest value from a rough gem, realized it could develop a better way of doing things.

AI can grade diamonds

The company, founded in 1988 and based in Hod Hasharon, central Israel, embarked on the mammoth task of teaching AI how to grade diamonds.

That involved showing the AI model more than 30,000 diamonds that had already been graded by GIA (Gemological Institute of America) the world’s biggest lab. The more diamonds they showed it, the better the results.

Because Sarine deals in technology and not in physical diamonds, all those diamonds to train the computer model had to be borrowed.

That’s why Sarine’s first eGrading machines, installed in mid-2022, were located in factories in India, where over 90% of all diamonds are cut and polished.

“We started in southern India, where we have a facility with 400 employees to provide customer support,” says Ben-Ari.” The next step will be a rollout to Botswana and Namibia, both counties which mine and manufacture diamonds.”

Lab-grown diamonds

We’ve been talking so far about “natural” diamonds, but what about lab-grown diamonds?

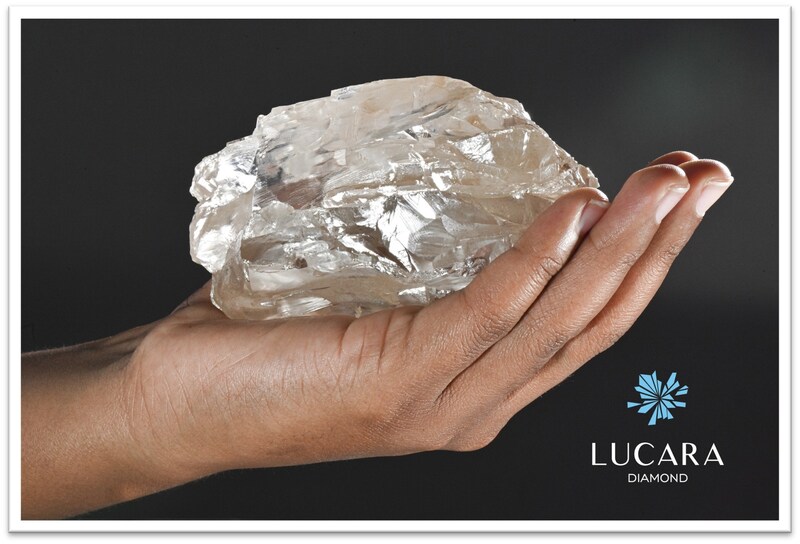

Natural diamonds formed miles below the Earth’s surface under high pressure and high temperature in a process that took over more than a billion years.

Lab-grown diamonds are created within weeks, are optically and physically identical to natural diamonds, and now sell for a fraction of the price.

They have driven the need for cheaper grading because in many cases the cost of an ordinary certificate outweighs the cost of manufacturing the diamond.

There are, however, some complex technical differences between natural and lab-grown diamonds, which means Sarine technology can grade them in the lab but not yet remotely with eGrading at factories. Sarine is working on an AI fix for that.

Source: Jason Harris