Global diamond giant De Beers said it will go ahead with a planned $1 billion investment to extend the life of its flagship Jwaneng mine in Botswana, even as last year’s downturn in gem demand persists.

The Anglo American (AAL.L) unit and the Botswana government, which jointly own Debswana Diamond Company, have approved the spending that will convert the Jwaneng pit into an underground operation.

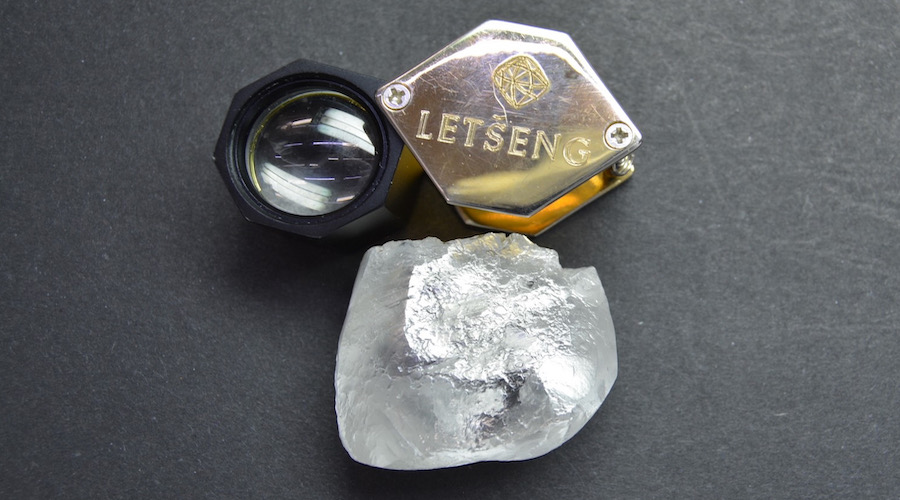

Debswana said in 2018 it planned an investment to extend the lifespan of the mine by 11 years from 2024. De Beers said the spending is necessary as long-term supply of rough gems is expected to tighten.

Angola last year started mining at its new Luele project, the biggest in the country and one of the world’s largest by estimated resources, despite depressed diamond demand.

“The global supply of natural diamonds is falling, so moving forward with the Jwaneng underground project creates new value for investors,” De Beers CEO Al Cook said.

Demand for rough diamonds has been weak in recent months with India – cutter and polisher of 90% of the world’s rough diamonds – asking global miners to stop selling it gemstones to manage accumulated stocks.

“This investment is aligned with our strategy to prioritise investments in the highest quality projects,” Cook said.

De Beers last year agreed a new diamond sales pact, which will see the government’s share of diamonds from the Debswana joint venture gradually increase to 50% over the next decade.

Source: Reuters