The Index tracking fancy color diamond prices fell during the last quarter, for the first time in almost four years.

The Fancy Color Diamond Index, which monitors pricing data for of all sizes and intensities of fancy color diamonds, fell by 0.7 per cent during Q2 2024, according to an update published yesterday (30 July) by the Fancy Color Research Foundation (FCRF).

The last recorded fall was back in Q3 2020 – in the depths of the Covid crisis – when the Index also fell by 0.7 per cent. That came after two quarters when sales were too slow for the FCRF to produce figures at all.

The trend over the last year or so has been of slower growth. The Index was up 1.3 per cent in Q1 2023, followed by +0.5 per cent (Q2); +0.4 per cent (Q3); +0.1 per cent (Q4) and +0.1 per cent (Q1 2024).

The New York-based FCRF played down the Q2 dip, describing it as “a minor fluctuation when compared to broader market movements”.

It said in a statement: “This stability is particularly evident relative to the sharper declines in the white diamond market and the Dow Jones index, which fell by 3.6 per cent and 1.7 per cent respectively during the same period.

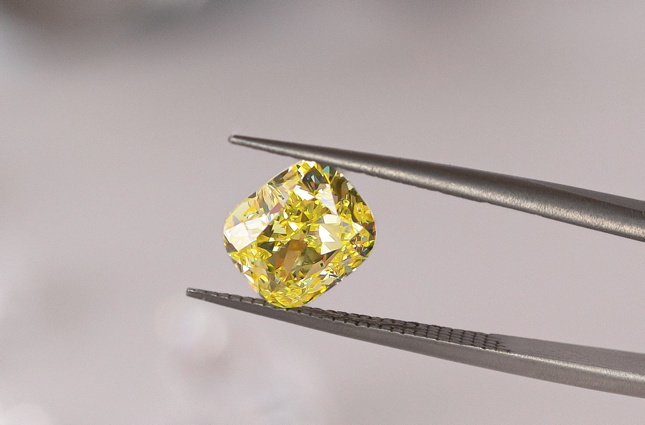

Yellow diamonds (all sizes, all intensities) suffered the biggest drop, down 1.7 per cent. Pinks and blues were both down 0.3 per cent.

The FCRF said its Index had enjoyed an overall increase of 211 per cent since it began compiling data in 2005. During that time it said the price of yellow diamonds had risen by 56 per cent, pinks by 398 per cent and blues by 248 per cent.

Source: Idex