Botswana has reached an eleventh-hour deal with diamond giant De Beers after months of tense negotiations that saw the continent’s top producer threatening to cut ties with the storied company.

The Botswana government and Anglo-American, the majority owner of De Beers, have reached an “agreement in principle”, the two sides said in a statement issued late Friday.

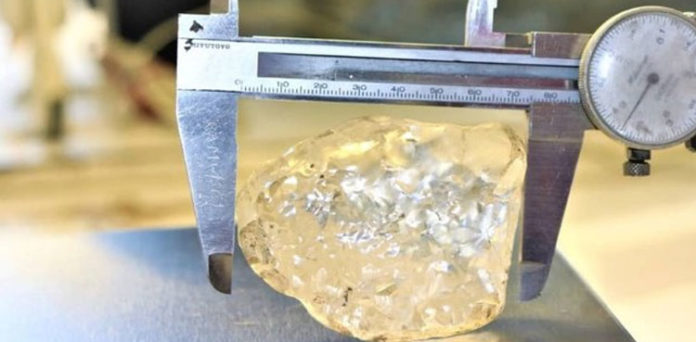

The agreement provides for a new 10-year agreement to sell the rough diamonds produced by Debswana — a joint venture equally owned by the government and De Beers — and a 25-year extension of its mining licenses.

The agreement also gives Botswana an increased 30 percent of diamond production for sale via the state-owned Okavango Diamond Company, progressively increasing to 50 percent in the final year of the contract, De Beers said in a separate statement on Saturday.

No value was given for the agreement.

The previous 2011 sale agreement between the southern African country, one of the continent’s richest, and the world’s largest diamond company by value, was extended exceptionally until June 30, 2023, due to the coronavirus pandemic.

Under terms negotiated by the two sides in 2011, De Beers received 90 percent of the rough diamonds mined, while Botswana had 10 percent to sell itself.

In 2020, Botswana’s share was hiked to 25 percent.

President Mokgweetsi Masisi had threatened to cut ties with the company if the latest talks proved unfavourable for his country.

“If we don’t achieve a win-win situation each party will have to pack its bags and go,” he said in February.

The country turned up the heat the following month by announcing it would soon conclude an agreement to take a 24 percent stake in the Belgian diamond manufacturer HB Antwerp.

Last year, De Beers obtained about 70 percent of its rough diamonds from Botswana.

Diamond mining accounts for a third of the landlocked country’s GDP.

Source: arynews