DCLA to Continue Full Grading of All Diamonds, Including Laboratory-Grown

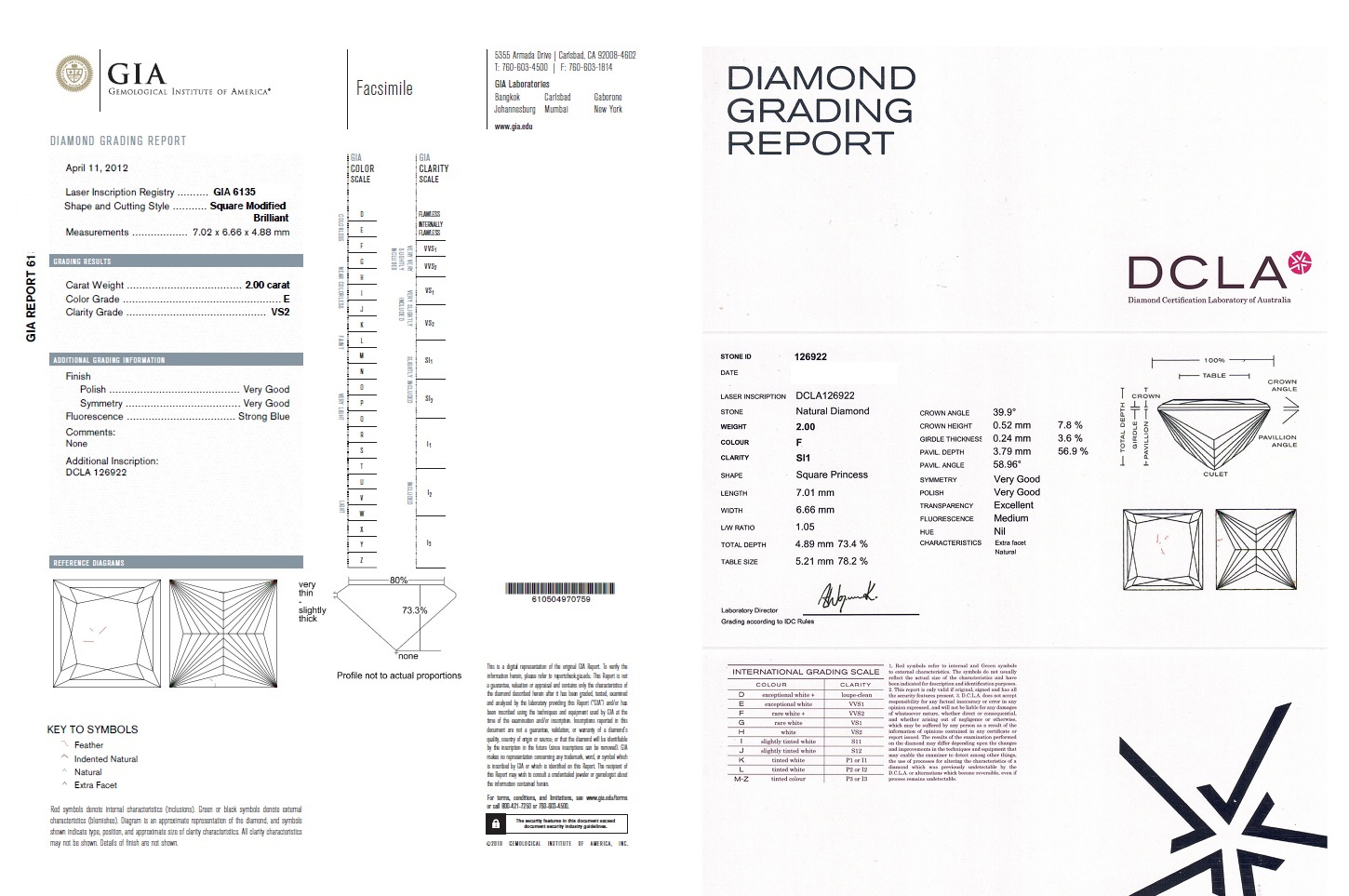

The Diamond Certification Laboratory of Australia (DCLA) reaffirms its commitment to providing precise and comprehensive grading for[…]

Dazzling Diamonds and Storied Provenance Headline Sotheby’s New York High Jewellery Auction

Sotheby’s New York is set to host an extraordinary High Jewellery auction on 13 June, featuring 110[…]

GIA Moves to Redefine Lab-Grown Diamond Grading, Signaling Clearer Divide from Natural Diamonds

GIA Moves to Redefine Lab-Grown Diamond Grading

World’s Longest Diamond-Stud Necklace

Jewelers based in Dubai have set a world record with a diamond-stud necklace that's 108 meters long.

Why Diamond Grades Can Differ Between Laboratories: Understanding Colour and Clarity Variations

The difference in diamond grading between laboratories like GIA (Gemological Institute of America) and DCLA (Diamond Certification[…]

Graff Opens Huge Store in Las Vegas

Graff has opened its biggest store in North America, at the Fontainebleau Las Vegas luxury resort and

35 ct Kashmir Sapphire sets World Record

A 35.09-carat sapphire yesterday (27 May) set a new world record for the highest per-carat price paid[…]

3 ct Pink Diamond could Fetch $1.6m

A fancy intense 3.03-carat pink diamond is among the highlights at Phillips' New York Jewels Auction next[…]

392 ct Blue Belle Sapphire could Fetch $12m

The Blue Belle sapphire and diamond necklace is to lead a Christie's New York sale next month[…]

$28m Emergency Funding as Lucara Sales Dip

Lucara is drawing down up to $28m in emergency funding for its underground mine expansion after reporting[…]