A collection of 21 pieces by the celebrated jeweler JAR (Joel Arthur Rosenthal) is expected to sell for at least $3m at Christie’s Geneva.

It’s described as “one of the largest and most important private collections of works by the visionary designer”.

JAR is one of the most sought-after contemporary jewelers, known for his use of unconventional materials and techniques, and for drawing on flora and fauna as his inspiration.

His exclusive boutique, in Place Vendome, Paris, admits clients only by personal approval or recommendation and produces just 70 or 80 pieces a year.

The collection – A Bouquet of Gems: A Superb Collection Of Jewels By JAR – will be offered for sale at the Magnificent Jewels sale on 14 May.

They were acquired for a single private collector in the early 2000s and 2010s and none of them has previously appeared on the market or at auction.

Highlight of the sale is the 2009 sculptural diamond Apricot Blossom bracelet (pictured) with an estimate of $340,000 to $570,000.

A multi-gem chain necklace of round brown diamonds, emeralds, tourmalines, tsavorite spessartine garnets, peridots, purple, orange, pink sapphires and sapphires, topazes, fire opals, rubies, pink and purple spinels, amethysts, and aquamarines, has an estimate of $285,000 to $400,000.

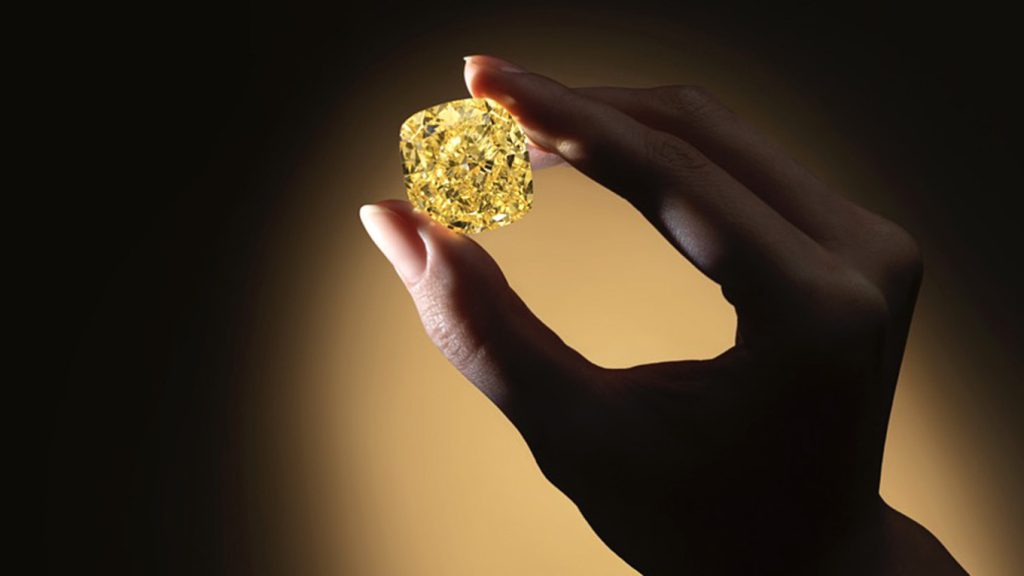

And a 2006 ring, with a 6.36-carat cushion modified brilliant-cut diamond, and black diamonds, is offered with a $160,000 to $230,000 estimate.

Source: IDEX