The first lady of Sierra Leone has joined protests against owners of the Koidu diamond mine, supporting strike action and demanding pay rises and improved working conditions.

Fatima Maada Bio, wife of president Julius Maada Bio, publicly highlighted the demands of workers and posted a message on her official X (formerly Twitter) account.

“As a proud daughter of the soil, I joined my brothers and sisters working at the Koidu Limited Mining Company in Kono Town to peacefully protest,” she wrote.

“Our collective action aimed to urge Koidu Limited to enhance working conditions and provide better services for all employees.”

She said among the key demands were recognition of the union, living allowances, a 30 per cent salary increment, overtime compensation, the provision of incentives, access to safe drinking water, and freedom of financial choice.

“This protest is a call to action for the company to improve the working conditions and provide better services. We believe that these demands are reasonable and essential for maintaining the well-being and dignity of workers.”

Workers at the mine have long complained about low wages, poor working conditions, and alleged racism, and protests have, in the past, turned violent.

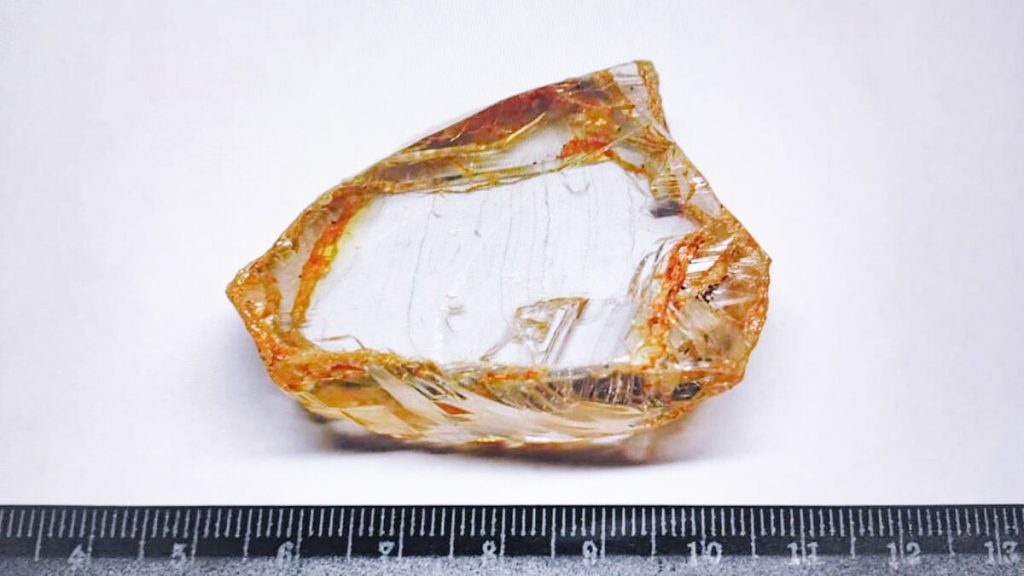

Koidu, a subsidiary of the Octea Diamond Group, was the first to begin commercial diamond operations after the country’s 11-year civil war in 2003.

In a statement on what it described as the “illegal strike action” last week, Koidu Limited said: “Our absolute priority remains the safety and wellbeing of our employees and the community. We maintain our position of zero tolerance to any violence, intimidation or incitement thereof. The government of Sierra Leone has offered the full support of its security forces.”

The company said it wanted to engage in direct negotiations as soon as possible to address all of these concerns, but could only do so if the industrial action is called off immediately.

“Failure to work within the laws of Sierra Leone, as well as the continuing of incitement of actions to obstruct workers from returning to work (particularly violence), is likely to result in the withdrawal of all staff from the mine on the grounds of safety.

“This will result in the ceasing of all operations; an existential threat to the mine itself.”

Source: IDEX

PS: Sierra Leone: The Original Blood Diamonds

Sierra Leone, a West African nation blessed with abundant natural resources, is synonymous with the term “blood diamonds”—a phrase that evokes images of conflict, human suffering, and illicit trade. These diamonds, also known as conflict diamonds, played a devastating role in the country’s brutal civil war from 1991 to 2002, financing rebel groups and fueling atrocities. Understanding Sierra Leone’s blood diamond history is essential to appreciating the industry’s evolution and the ongoing efforts to prevent such tragedies from recurring.

The Rise of Blood Diamonds

Sierra Leone’s diamond wealth has long attracted fortune seekers and corporations, but it also became a curse. Diamonds were first discovered in the country in the 1930s, and by the 1950s, Sierra Leone had established itself as a significant diamond producer. However, much of the mining was conducted informally, leading to smuggling and corruption.

The real tragedy began in 1991 when the Revolutionary United Front (RUF), a rebel group, launched a war against the government. The RUF quickly realized that controlling diamond mines meant securing a near-endless source of funding for weapons and operations. The group forced civilians, including children, into grueling labor in the mines, extracting diamonds that were then smuggled through neighboring countries and sold on international markets. These diamonds were used to purchase arms, prolonging the conflict and leading to widespread atrocities, including mutilations, mass killings, and child soldier recruitment.

International Response and the Kimberley Process

By the late 1990s, reports detailing the horrors of Sierra Leone’s blood diamonds gained global attention. The international community, led by the United Nations, took action to curb the trade of conflict diamonds. The Kimberley Process Certification Scheme (KPCS) was introduced in 2003 to prevent blood diamonds from entering the legitimate market. The initiative requires diamond-producing nations to certify that their exports are conflict-free, aiming to eliminate the link between diamonds and violence.

While the Kimberley Process has reduced the trade of conflict diamonds, criticisms remain regarding its effectiveness. Loopholes, weak enforcement, and the continued smuggling of diamonds in war-torn regions highlight the need for ongoing reforms.

The Present and Future of Sierra Leone’s Diamond Industry

Since the end of the civil war in 2002, Sierra Leone has made significant strides in stabilizing its diamond sector. The government has implemented stricter regulations, and international oversight has increased. Today, diamonds remain a crucial part of Sierra Leone’s economy, providing jobs and revenue. However, challenges such as illegal mining, corruption, and poor working conditions persist.

Ethical sourcing initiatives, including Fair Trade diamonds and blockchain technology for traceability, are helping to ensure that diamonds from Sierra Leone and other regions are mined responsibly. Companies and consumers are increasingly demanding conflict-free diamonds, putting pressure on the industry to maintain transparency and ethical practices.

Sierra Leone’s tragic history with blood diamonds serves as a stark reminder of the potential dark side of the diamond trade. While progress has been made, the industry must remain vigilant to prevent history from repeating itself. For consumers, choosing diamonds certified as conflict-free and supporting ethical mining initiatives can contribute to a future where diamonds symbolize love and commitment, rather than conflict and suffering.

The legacy of blood diamonds in Sierra Leone is a painful one, but it also highlights the resilience of its people and the ongoing global efforts to ensure that diamonds never again finance war and human suffering.