Tiffany & Co. has reported Q3 worldwide net sales of $853 million, up 4 % year on year.

Tiffany & Co continues to maintain a cautious near-term outlook about global economic conditions, but, it expects results to improve during the holiday season.

Tiffany & Co annual net earnings are expected to be $409-$435 million. Tiffany has lowered its sales expectations to 5-6 % versus.

Japan is the best performing market with total sales of $147 million.

Blue Nile’s sales rose 20 % year on year for the third quarter of 2012. Turn over for the third quarter was $89.8 million.

4 quarter sales are expected between $140 million and $153 million, compared with $112 million in the fourth quarter of 2011.

We are excited to report solid results in the third quarter, with accelerating revenue growth and expanding earnings per share, Said Blue Nile.

With continued steady execution of our strategy coupled with exciting product offerings for the holiday season, we believe we are well positioned to achieve our goals for 2012.

The stones will be grown using the chemical vapour deposition (CVD) process at a facility located of Washington, D.C., Washington Diamonds Corp has been able to grow stones as large as 2.30 carats.

The company plans to produce stones of one carat or slightly larger in size, Concentrating in colours ranging from G to J colour and VS1 to SI2 clarity.

Gemesis a well-known Laboratory grown diamond producing company began selling colourless diamonds online direct to consumers this year. Gemesis also once had diamond growing facility in Sarasota. It now produced stones overseas.

Late last year Scio Diamond Technology bought the assets of Apollo Diamond a Boston based synthetic diamond Production Company, and has plans for a jewellery division that would include colourless synthetic (CVD) stones.

The 35th World Diamond Congress has taken strong exception to the Diamond Source Warranty Protocol, a chain of custody initiative announced by a group of American organizations.

Addressing a press conference at the conclusion of the congress on Wednesday, Earnest Blom and Maxim Shkadov, the new Presidents of the World Federation of Diamond Bourses (WFDB) and the International Diamond Manufacturers Association (IDMA) respectively, said their organizations would enter into “immediate and intense” dialogue with their American colleagues to resolve this matter. The initiative was announced by the Jewellers of America (JA), the Jewellers Vigilance Committee (JVC) and the Diamond Manufacturers and Importers Association (DMIA). Blom said the congress had not come up with a resolution on the idea of imposing a levy on rough sales by miners to fund generic promotions. However, the idea was going to be taken forward. “Both the WFDB and IDMA will talk to the producers to discuss the feasibility of this,” he said. “We don’t exist in isolation. If they don’t have a robust mining business, we won’t have raw material supply. If we aren’t able to promote or product, they won’t have a market to sell to,” he added. He noted that the WFDB’s World Diamond Mark initiative, which was still in the process of being rolled out, offered the potential to generate substantial funds for the industry, which could go towards promotions. “Whichever idea works will be followed up on,” Blom said. Both organizations expressed joint appreciation at the efforts by the Chair of the Kimberley Process to consult all industry stakeholders on the new definition for conflict diamonds and to assure that any decisions made are reached under complete, industry-wide consensus. Blom said the diamond industry was convinced that there was a definite place in the market for synthetics, but that they had to be clearly and completely disclosed. The congress also discussed measures to keep the diamond industry sustainable – primarily ensuring that it was made attractive enough for the new generations to enter into as also attracting new talent. Source: IDEX

De Beers rough diamonds sight is estimated to be $750 million USD, The DTC sold the October sight, and maintained relatively stable pricing.

Some previously deferred sights were also taken up by the sightholders. This made the October sight the most valuable De Beers sale so far in 2012. DTC also had very few refusals of Sight goods this month. Some DTC boxes were trading on the secondary market at low single percentage premiums, or even at discounts.

Blue Nile the online jewellery behemoth has added the Spanish and French language and currency options to its global website.

This enables customers around the world to shop at Blue Nile in six different languages, including traditional and Simplified Chinese and Japanese. BlueNile is Constantly improving service and the online shopping experience for international customers and it is one of BlueNile’s primary goals.

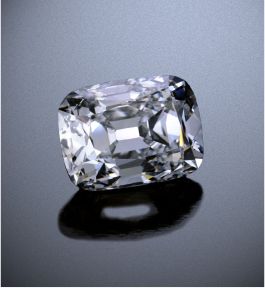

Archduke Joseph Diamond will be offered at auction in Geneva in November 2012.

One of the most famous diamonds in the world, the impressive 76.02 carat. D colour, internally flawless diamond. Traces its origin is to Golconda mines in India where some of the best diamond crystals are found.

The Diamond is expected to fetch well over $15 million when it hits the auction block.

Botswana now boasts diamond production, cutting and polishing, jewellery manufacturing and finally rough diamond trade.

The bourse will provide a platform for producers, brokers, valuers and traders, with new tenants having already taken up residence in the building, adding to the diamond industry chain.

This will make Botswana a vibrant market for diamonds. It is expected that government will market its allocation of Debswana production through the new bourse.

The DTP is a private initiative funded by Safdico, a Diamond Trading Company.

The Indian diamond industry’s liquidity crisis – said to be the worst in 50 years – is claimed to be self made as big and medium diamond firms have diverted $5.4 billion in bank finance for diamond operations into real estate, according to a report published in The Times of India.

Some diamond firms reportedly used finance obtained from several high-street lenders to dress up past losses on their books.

With real estate prices now falling, these firms are now caught in a crunch. The situation is compounded by speculative buying of rough diamonds over the past two years. Rough diamond prices also declining.

De Beers Diamond trading Company (DTC) reduced sight prices by an estimated average of 8 % at its week. The sights total value is estimated at $580 million USD and all site boxes were taken.

Price were down across the range with reductions of up to 17 % for better-quality goods.

DTC is said that rough prices have now in line with polished, which have since stabilized.

DTC sales have declined by 23 % year on year to about $4 billion.