LUCAPA TO SELL LARGE AND EXCEPTIONAL DIAMONDS IN “HISTORIC” AUCTION

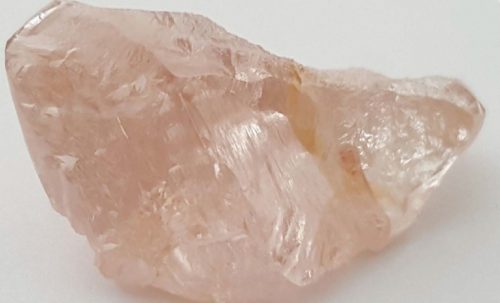

The seven Lulo diamonds to be offered include a 46 carat pink diamond

Graff Hong Kong to Display Lesedi Polished

Graff will present a selection of flawless polished stones from the 1,109-carat Lesedi La Rona at its[…]

Mumbai Exchange Mulls Lifting Synthetics Ban

Mumbai’s Bharat Diamond Bourse (BDB) is considering allowing synthetic-diamond trading on the exchange premises, its president told[…]

Marie Antoinette Pendant Sells for $36M

A natural pearl and diamond pendant belonging to Marie Antoinette smashed its price estimate and capped off[…]

19 carat Pink Legacy sets a world record at a Christie’s auction

Magnificent Jewels auction sold 86% of lots grossing a total of $110.2 million USD.