Two Stone Fancy Vivid Blue Diamond Ring Could Fetch $8 million At Christie’s New York Auction

Fancy Vivid Blue Diamond Twin Stone Ring

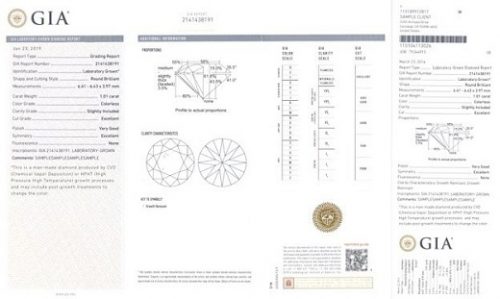

88 Carat Flawless Diamond Fetches $13.7 Million USD

$13.7 million for the flawless 88.22 carat diamond

Last kimberlite trucked to plant at De Beers Victor mine

The last truckload of kimberlite from Ontario’s first and only diamond mine has left the pit. De[…]

Thieves tunnelled into jewellers to take £1,000,000 in diamonds and gems

George Attenborough and Son Jewellers on Fleet Street in central London

Petra Diamonds shares jump on 425-carat discovery at Cullinan

Petra Diamonds 425.10 carat D Colour Rough Diamond