The 10.10 carat oval shape, vivid blue diamond flawless diamond sold for $42 Million ( $32 Million USD ) , it took just minutes to hammer at Sotheby’s Hong Kong.

The Vivid Blue diamond named the De Beers Millennium Jewel 4 is one of the De Beers Millennium Jewel collection.

The exceptional diamond recovered at a mine in South Africa is the largest diamond of its kind to appear at auction.

The Diamond was purchased by an anonymous telephone bidder at a record price for a gemstone at auction in Asia.

Christie’s is set to auction the exceptional 14.6 ct Vivid Blue diamond, it could sell for as much as $45 million a new record for a blue diamond.

Blue diamond is one of the rarest and valuable of colours, the colour comes from the carbon bonding with boron.

Only one in ten of all blue diamonds are larger than a carat and fewer have the highest colour rating of vivid. Vivid is the purest blue colour, dark rich, navy blue.

The diamond, called the Oppenheimer Blue, was owned by Philip Oppenheimer, the late chairman of the De Beers diamonds.

Lucapa Diamond Company has recovered the largest recorded diamond ever found in Angola.

The 404.2 carat rough diamond has been confirmed as type IIa D colour, according to Lucapa’s statement.

Lucapa is a listed Australian Securities Exchange company recovered the exceptional rough diamond at Mining Block 8 of the company’s Lulo Diamond Project in Angola.

Mining Block 8 has already produced more than 60 large diamonds since mining August 2015. Previous largest diamond from Lulo was 133.4 carats and the previous Angolan record was set by the 217.4 carat Angolan Star recovered from the Luarica mine in 2007.

Lucapa holds a 40 percent interest in the alluvial diamond mine it operates in Lulo, Endiama has a 32 percent interest and private local partner Rosas & Pétalas holds the remaining 28 percent.

Lucara Diamond Corporation in Botswana has officially named the largest diamond to be discovered in 100 years.

The name is "Lesedi La Rona", which means "our light" in Setswana.

The diamond is second in size only to the Cullinan diamond discovered in South Africa.

The diamond will likely be sold by the middle of this year. Lucara will not polish the diamond before selling it.

Graff Diamonds first Australian boutique has opened in Crown Melbourne.

The latest store will house Graff’s exceptional diamonds, gemstones and timepieces.

CEO Francois Graff said over the pasted fifteen years Graff has opened in Europe, the Middle East, Asia and North America.

Graff stores are in fifty five locations in the most luxurious shopping destinations around the world.

Six more people have been arrested in relation to the hacking of Gemological Institute of America (GIA) diamond-grading reports by outside parties as the investigation into the case continues.

A total of eight arrests have now been made as a result of cooperation between the GIA, the Indian authorities and Tata Consultancy Services (TCS), the contractor that supports GIA databases, according to a GIA statement January 26.

In another development, the GIA has extended its submission date for the confirmation service for members of the trade concerned about the validity of their grading reports by two months to March 31, 2016.

Members of the trade with a GIA report originally issued between November 2014 and October 2015 who are concerned about its validity may submit the original report and the referenced diamond to any GIA location at no charge by the new deadline.

To date only 297 of 1,042 invalidated reports have been returned to the GIA. As of November 26, only 175 of the reports had been returned and two arrests had been made.

“It is imperative that all of the diamonds and their reports be returned to GIA to remove the fraudulently altered reports from the market,” the statement said.

De Beers the sold $540m worth of diamonds in its first of sale of the year more than double the value of the sales achieved in the final sight of 2015.

Prices for rough diamonds softened last year because of an oversupply of diamonds in the production centres forcing companies such as De Beers and Alrosa, to cut their supply of rough to the market in an effort to restore prices.

Rough diamond demand broadened across the entire range as cutting and polishing factories began to increase their production.

De Beers has said it will change the way it operates its sights to become more flexible and responsive to its clients.

Before you sell jewellery, see what DCLA Services can do for you:

Get real values and advice from the experts on all gold jewellery and valuables.

DCLA Services will guarantee to get you the best price for Diamond Jewellery and gold jewellery.

Need Cash Loans for Diamonds or Gold and silver Bullion, or wish to liquidate Estate Jewellery or Diamond Jewellery Contact DCLA Services before you sell Diamonds,Gold and Silver.

Verbal one on one valuation services are free.

Visit: www.dclaservices.com

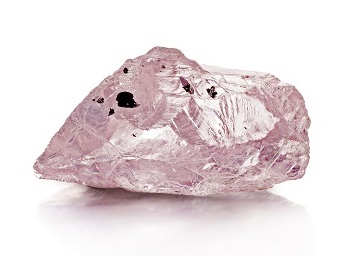

The 23.16 carat exceptional pink diamond recovered at the Williamson mine in Tanzania has been sold to M.A. Anavi Diamond Group for 433,938 per carat or$10,050,000 for the stone.

Petra will retain a 20 percent interest in resultant polished sales. This sale result affirms that the market for high quality coloured diamonds remains robust, said Petra CEO Johan Dippenaar. “

Pinks of this size and quality are incredibly rare, but the Williamson mine is known to produce them from time to time.

Anglo American De Beers ended more than 125 years of diamond mining in Kimberley South Africa by selling its last remaining assets.

De Beers which dominated the diamond industry for more than a century said, a consortium formed by Petra Diamonds and South African firm Ekapa Mining will pay close to $7.2 million for the mines.

Petra has the historic Finsch and Cullinan mines will pay around $3.6m for a 49.9% stake in the mines while Ekapa will hold the rest.

Petra’s shares soared on the news. They were trading more than 12% higher at 71.87 pence at 3:15 pm GMT.