Sales slide at Tiffany & Co as tourists tighten their purses

Sales performed below expectations for Tiffany & Co during the first quarter of 2019. For the three[…]

Lucapa diamonds sell for $14.5 million at auction

Lucapa Diamond Company has continued its successful run at auction after securing $US10 million ($14.5 million) for[…]

RapNet Members Say ‘No’ to Synthetics

The RapNet community has voted overwhelmingly against introducing services for the lab-grown-diamond sector. Members voted by 79%[…]

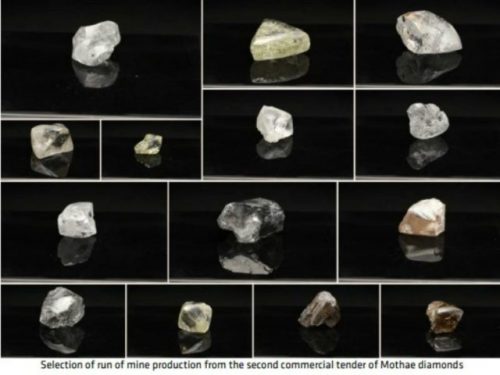

Rough diamonds from Mothae fetch US$3.5 million in Antwerp

Lucapa Diamond Company and the Government of Lesotho have announced results from the second tender in 2019[…]

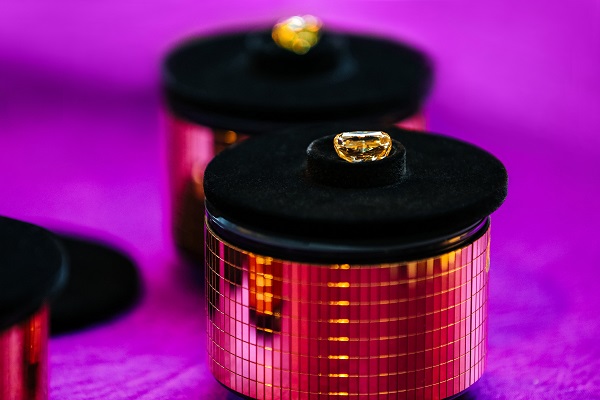

Pink Diamond fetches $2.2M USD Per carat at Christie’s

A pink diamond ring named for its resemblance to bubble gum fetched $7.5 million at Christie’s Hong[…]

Undisclosed Green Synthetics Raise GIA Eyebrows

Twenty five undisclosed lab grown diamonds have turned up at the Gemological Institute of America (GIA)

RapNet to Vote on Synthetics

RapNet, the world’s largest diamond trading network with daily listings of over $7.4 billion, will be voting[…]