Gem Diamonds finally sells its failed Botswana mine

The miner has sold Ghaghoo for a fraction of what it cost to build as it fails[…]

De Beers Can Do More, Botswana Group Says

A Botswana employers’ advocacy group has called out De Beers for failing to provide substantial opportunities for[…]

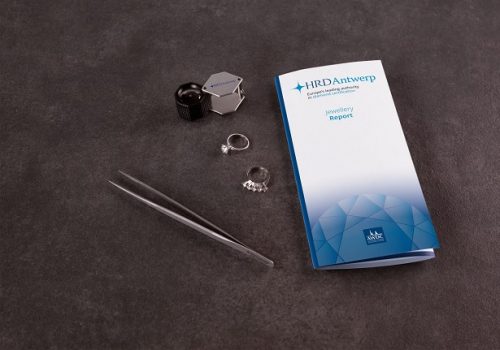

HRD Antwerp opens new drop-off point in Hatton Garden

HRD Antwerp has expanded into the UK market with the opening of a new drop-off point in[…]

US Polished Imports Slump in April

The US polished diamond trade slowed in April, with imports declining and exports stable. The drop in[…]

Rare Golconda Diamonds

The Nizam of Hyderabad’s diamond encrusted ceremonial sword and Shah Jahan’s jade hilted dagger are some of[…]