To help the Diamond industry limit losses when polished prices fluctuate. The Indian Commodity Exchange has launched the first diamond futures trading contract.

Diamond futures contracts work as price insurance, when fluctuations impact the value of inventories. With the futures trading traders agree on a price for a contract.

The new exchange platform gives investors a format similar to commodities exchanges such as Comex, Nymex and the London Metal Exchange.

Over 100 members and approximately 4,000 clients have registered with ICEX exchange.

The Indian government approved diamond futures trading in September 2016.

De Beers marketing spend this years is more than $140 million, This is the biggest De Beers push in a decade.

The marketing will focus on increasing consumer demand for diamond jewellery in US, China and Indian markets.

The De Beers brands, Forevermark and De Beers Diamond Jewellers. Will receive the most funding, But Debeers will also increase its contributions to the Diamond Producers Association and India’s Gem & Jewellery Export Promotion Council.

Stephen Lussier, De Beers’ executive vice president of marketing and CEO of Forevermark. Said the consumer expenditure for diamond jewellery over the past five years collectively has been the highest on record. and this made the outlook positive.

Taylor Swift Diamond Bath

In Taylor Swift’s new music video for “Look What You Made Me Do.” The pop star is seen sitting in a bathtub full of diamonds.

Well surprise they used real diamonds, no fakes. The Jewellery pieces were on loan from celebrity jeweller Neil Lane. And have a value of well over $10 million USD.

Sarine Technologies the world leader in diamond measuring and assessing is expanding its diamond report. It will include the 4C’s quality grades including the diamond’s cut, color, clarity and carat weight. This will be done using its own automated grading tools.

To get these grades for the diamonds Sarine is using its Clarity and Colour machines unveiled last year.. The two machines can automatically measure a diamond’s clarity and color, a skill usually performed by trained gemologists in laboratories like the GIA, HRD, DCLA and others.

Sarine claims it can deliver quality diamond grading with less subjectivity and fewer human errors, adding that the move would raise confidence.

Sarine is collaborating with Swiss gemological lab GGTL Laboratories on the technology.

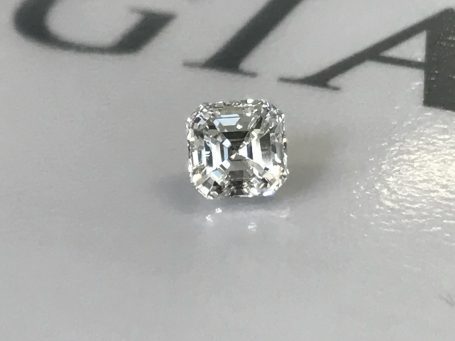

The Asscher Cut Diamond, A Royal diamond cut, With the most light return of all step cut diamond shapes.

The Royal Asscher is owned by the Asscher family, a diamond dynasty with a 157 years of legacy.

In 1854 Joseph Isaac Asscher, a diamond artisan, established the I.J Asscher diamond company, named for his son Isaac Joseph Asscher, who followed in his father’s footsteps and entered the diamond industry.

Her Majesty Queen Juliana of the Netherlands granted the Asscher Diamond Company a royal title in 1980. A tribute to the century old leading role the Asscher family and company played in the diamond industry.

With this honor, the Asscher Diamond Company became the Royal Asscher Diamond Company.

Michael Hill’s US sales dropped in the past fiscal year as the Australia-based jeweler struggled in the key market.

Revenue from American operations slid 12% to $12.5 million, while same-store sales fell 8.5%, the retailer reported Monday.

Michael Hill has attempted to revive growth in its US network by appointing Brett Halliday — a successful head of the group’s Canada division — as head of the stateside business. However, the US stores continued to perform weakly, Michael Hill said.

“Our US business underwent a lot of change during the year including a leadership change and a new advertising direction,” the company said. “As a result, it struggled to improve performance.”

The company closed a store in Columbus, Ohio, due to poor performance, and wrote off the value of its outlet in Roosevelt Fields, New York.

Halliday “is reviewing the US business based on his learnings from the Canadian market and making adjustments to the model as required,” Michael Hill explained.

Total company revenue grew 6% to $461.8 million (AUD 583 million), driven by a stronger performance in Australia, where sales increased 4%, and Canada, where revenue leapt 18%. Sales in the retailer’s New Zealand stores slipped 0.8%. Group profit grew 67

Source: Diamonds.net

Lucapa Diamond Company announced Thursday it has recovered seven stones exceeding 50 carats at its Lulo mine in Angola, including two type IIa stones.

The two IIa stones weigh 68 carats and 83 carats. All seven rough diamonds scheduled to sell in September as part of the next parcel marketed by Sociedade Mineira Do Lulo the mining company in which Lucapa has a 40% stake.

The large diamond finds come from Lulo’s block 8, at which Lucapa recently resumed operations at the end of the wet season.

This area is known for yielding large diamonds, including Angola’s 404 carat rough diamond which is the biggest recorded and sold for $16 million.

Costco Wholesale Corporation ordered to pay Tiffany & Co. at least $19.35 million in damages after selling counterfeit diamond rings bearing the iconic jeweler’s name, a US federal judge ordered last week.

Costco to pay $11.1 million plus interest plus an addition to the $8.25 million in punitive damages that a jury awarded last October for Tiffany’s lost profit from the trademark infringement a US District Judge Laura Taylor Swain Said.

Evidence at the trial proved Costco had frequently reference Tiffany as a benchmark for style and quality, and placed rings labeled with the standalone word “Tiffany” next to branded luxury items.

The ruling sends a clear message to others who infringe the Tiffany mark.

Polished into a radiant-cut and rated as VS2 clarity.

The diamond named the Argyle Everglow, was revealed in New York as part of the 2017 Argyle Pink Diamonds Tender.

Red Diamonds are the rarest of colours. An very small percentage of the world’s mined diamonds are classified and graded as Fancy Red even less over one carat.

The origin of the colour of pink and red in diamonds is the result of an atomic misalignment in the lattice of the diamond, This affects the way light is refracted through the stone.

A better service and more secure way to send goods to the DCLA. Brink’s Low Value Parcel Shipping: Brink’s Connect offers an end-to-end solution for the logistics and distribution of smaller parcels valued at up to US$75,000, ideal for distribution of small shipments. For further information See: http://www.brinks.com/en/public/brinks-australia/diamonds-jewelry