The stunning gem aged from 120 to 230 million years was mined in Arctic Yakutia.

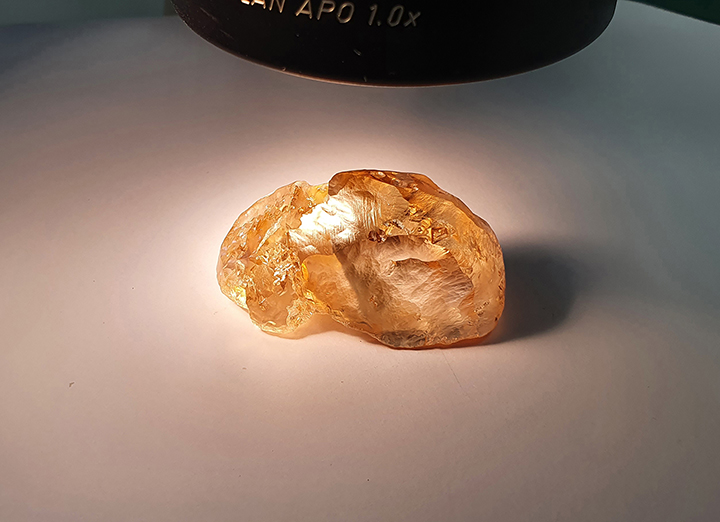

The rough diamond is of deep amber colour, its dimensions are 47x24x22 mm.

The precious discovery was made by workers of remote Ebelyakh mine on river Anabar in the extreme north of Yakutia, not far from shores of Laptev Sea and some 1,211km north west from Yakutsk.

The mine belongs to Diamonds of Anabar, part of ALROSA Group.

The rough diamond is of deep amber colour, its dimensions are 47x24x22 mm.

The decision hasn’t yet been made as to whether it’ll be sent to Alrosa’s in-house cutting and polishing division, or sold rough.

‘Such a large natural color rough diamond is a unique discovery.

‘Now, the stone is at ALROSA’s United Selling Organization being studied and evaluated by our specialists.

‘After that, we will decide whether to give it to our manufacturers for cutting or sell it as a rough.

‘Of course, cutters in any country will be interested in such a diamond, as it has the potential to give several high quality polished diamonds,’ said Pavel Vinikhin, head of ALROSA’s cutting and polishing division.

The Ebelyakh mine has produced several brightly-coloured rough diamonds in the past several years.

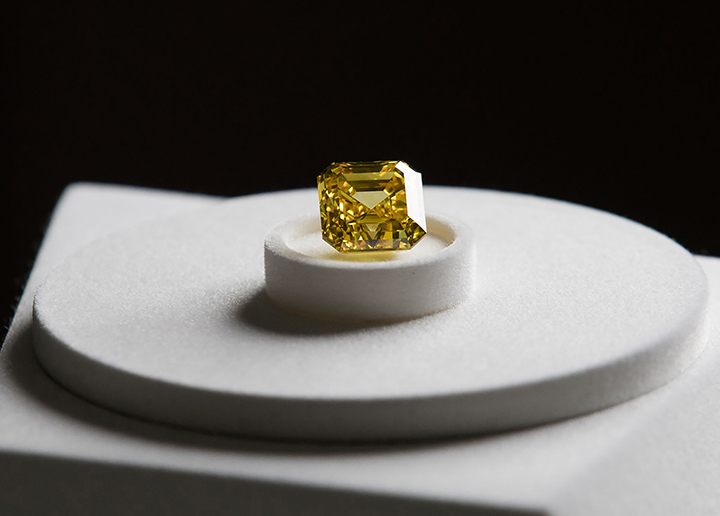

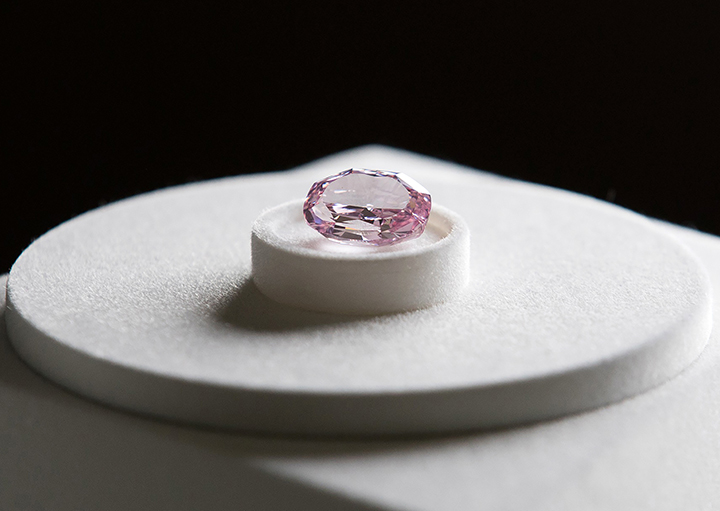

In summer 2017 alone a crimson, a pink and an intense yellow stones were found within a month.

Pictured below are the intense yellow and pink diamonds cut and polished from rough stones mined at Ebelyakh. Pictures: ALROSA

Source: siberiantimes