A diamond mine outside of Prieska in the Northern Cape of South Africa, became the latest victim of a robbery on Monday.

South African police are looking for a group of sixteen men who tied up security guards, before they demanded the safe keys from two employees.

Unable to access the safe, they broke into the sorting room, and managed to get away with an undisclosed quantity of rough diamonds.

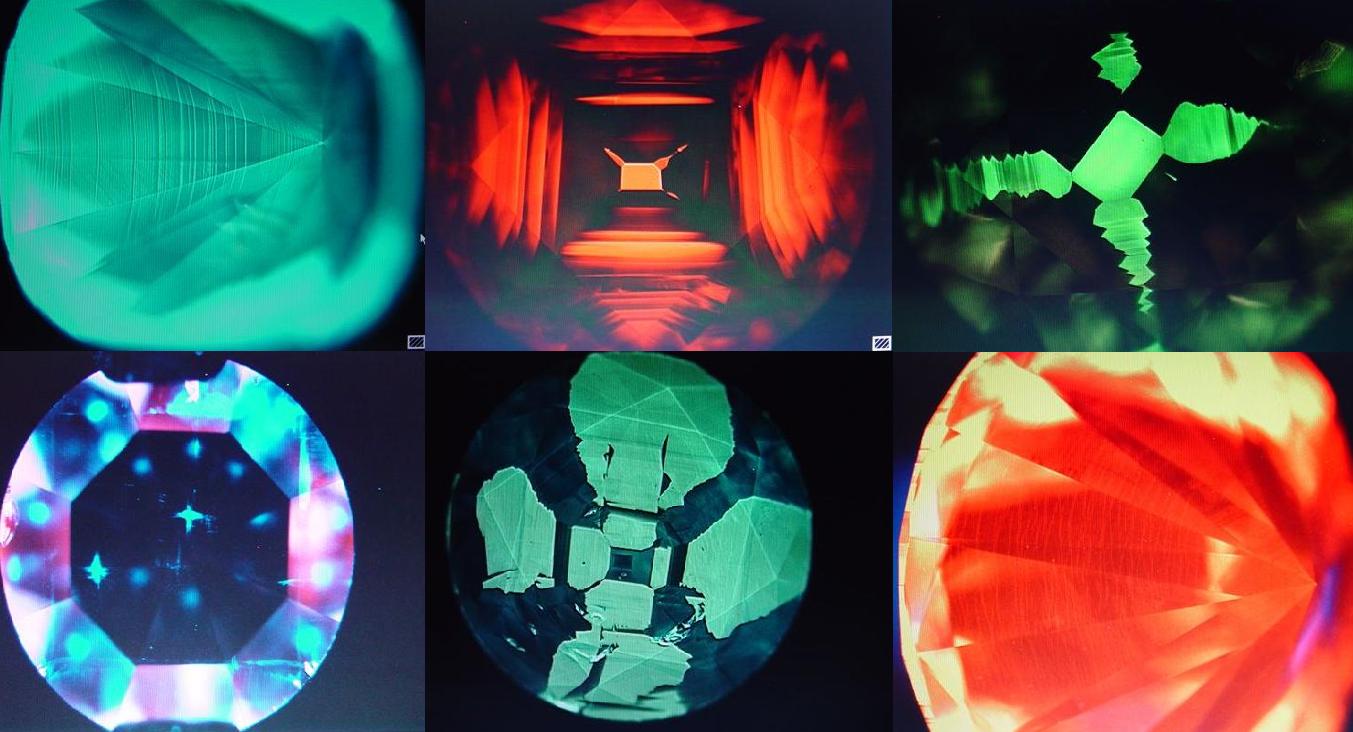

Two laboratory grown diamonds, the largest D colour internally flawless lab-created diamonds have been certified by IGI Antwerp laboratory.

Both stones are triple excellent and have no colour overtones or fluorescence. The diamonds were submitted by Diamaz International a leading supplier of laboratory grown diamonds based in Antwerp.

Technological advancements in HPHT have made it possible to grown diamonds in D to F colours from 1ct to 3 t with great consistency.

It is predicted demand for these high quality HPHT diamonds will soon outstrip supply.

ABN Amro, Standard Chartered, State Bank of India and IDBI Bank continue to reduce credit levels to jewellery companies.

Winsome Diamonds and Forever Precious Diamond had defaulted on a $970 million debt owed to creditors prompting banks to act. The Banks have classified gems and jewellery into the high risk category.

Jewellery industry representatives will meet with Finance Ministry officials on Tuesday In a bid to bring much needed liquidity into the industry.

Rio Tinto has identified a cluster of eight diamondiferous pipes in India.

Rio Tinto Global mining giant would invest $500 million in the diamond mine in Madhya Pradesh India. The potential project would create thirty thousand jobs when approval for the mining lease is granted by local authorities.

Rio Tinto’s CEO said the project would commence once the company has environmental clearance.

Recently there has been a lot of controversy in the diamond and jewellery trade regarding over graded diamonds. This led to one laboratory being banned from listing on Rapaport. Video

If you have any concerns about your diamond DCLA Laboratory will check it for you FREE of charge.

Rapaport Australian listed laboratory DCLA

DCLA and Cibjo

Contact DCLA for information

DCLA continues to see overgraded diamonds with no alert to the puplic from the industry associations in Australia.

Unscrupulous dealers have created havoc in the industry again, selling Lab grown diamonds in a mix with natural diamonds.

18 months after laboratory grown diamonds were found mix with natural mined diamonds, the industry is again dealing with the issue.

Leading diamond companies including (DTC) sightholders have been caught up in the illegal practice.

In a statement the GJEPC and SDA clarified that various steps have been initiated to curb the menace including stringent legal action against those caught selling the lab grown diamonds mixed with natural diamonds. As well as manufacturing lab grown diamonds without disclosure.

Israel’s polished diamond exports, increased one percent year on year to $6.27 billion in 2014, according to the Economic Ministry.

The United States is still the major market for Israel’s polished diamonds accounting for Thirty Eight percent of polished exports, Followed by Hong Kong with Thirty percent of Israel’s polished exports.

Polished imports grew five percent to $4.51 billion during 2014. Rough diamond imports increased one percent to $4.02 billion, and rough exports increased four percent to $3.06 billion.

The world diamond industry faced a significant credit crunch amongst other challenges including, higher rough prices. With the robust U.S. market and renewed Asian demand, Israel looks forward to increased trade for polished diamonds in 2015.

The GIA a gemmological organisation will be conducting a seven week graduate diamond diploma from January 8.

The programme combines theory lessons with practical hands on learning and will be held in Jaipur.

Students will learn how to grade in accordance with the GIA’s 4Cs colour, cut, clarity and carat weight of diamond in the D-Z colour range.

As well as how to grade diamonds and detect simulants and treatments like fracture filled diamonds using gemmological equipment.

The course will be taught by instructors from the Mumbai campus.

Mark Gershburg CEO of GSI said that after decades of just mining rough diamonds. Botswana capital Gaborone now cuts, polishes and sells diamonds.

This has created demand for gemmological laboratories. Therefore Gemological Science International has now opened a laboratory in Botswana’s trading centre.

Merry Christmas and Happy Chanukah to all our customers. We wish you all a successful, happy and healthy new year. Thank you for all your support and good wishes.