US change of ‘diamond’ definition has Indian exports worried

These stones have essentially the same optical, physical and chemical properties as mined diamonds

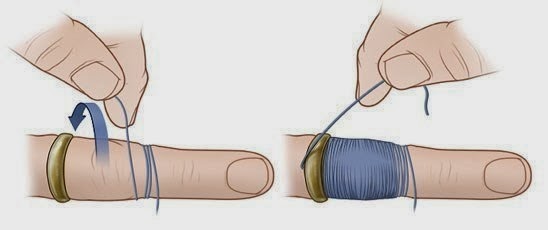

How to Remove a Stuck Ring Safely

A stuck ring can simply be the result of wearing a ring that's too small

GIA Spots Broken Diamond Glued Back Together

Graders noticed a large fracture and cavity on the table of the marquise-cut, 1.38-carat polished diamond submitted[…]

Manufactured diamonds will be to mined diamonds what Tudor is to Rolex

Manufactured diamonds will be to mined diamonds what Tudor is to Rolex

Pandora to Slash Nearly 400 Jobs

Pandora plans to lay off 397 employees after disappointing second quarter results

Lucapa Finds 3 More Special Diamonds at Mothae Mine

89 carat yellow stone from Mothae’s South East zone