Costco sells 6.5-carat diamond rings worth nearly $US400,000 amid the bulk groceries and home goods that lure bargain seekers to its warehouse stores.

Sky News reporter Jennifer Bechwati tweeted Sunday that she found a diamond ring costing 499,999.99 AUD (or roughly $388,900 USD) at a Costco store in Australia “between bulk AA batteries and dustpans.”

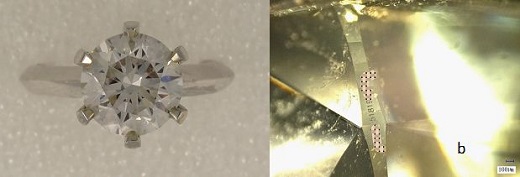

She posted a photo of the round-cut ring that listed its weight as 6.55 carats with colour and clarity of “G” and “VS1,” respectively. The diamond was set in a platinum band.

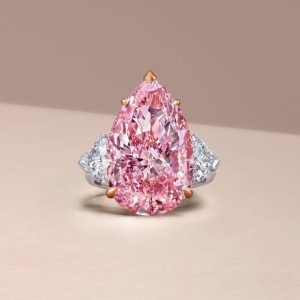

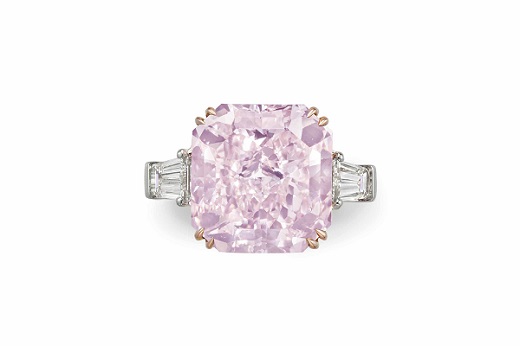

It turns out that the warehouse chain sells a host of expensive diamonds in stores and online. Costco’s US website lists 303 diamond rings with stones as big as 10 carats. Prices range from $US159 to $US420,000.

Shoppers might not expect to find such expensive rings in stores, but a Costco spokeswoman told the Daily Mail that every one of its warehouses has at least one “WOW” item in its jewellery department.

Costco was ordered to pay the jewellery company Tiffany more than $US19 million last year for selling about 2,500 rings falsely identified on store signs as “Tiffany” rings. Costco argued that the description referred to the rings’ settings, and wasn’t meant to be confused with Tiffany’s brand.

Source: businessinsider