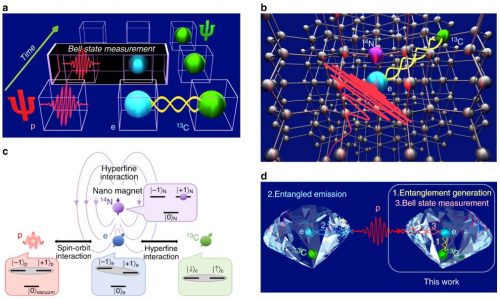

Tracking conflict diamonds with lasers

In a lab in the California city of Carlsbad, between Los Angeles and San Diego, a suspicious[…]

Frenchman jailed for five years in Brussels diamond heist

A Frenchman was sentenced Thursday in Belgium to five years in prison for his role in a[…]

De Beers Cuts Prices as Rough Sales Slide

De Beers employee sorting through rough diamonds with a loupe at the company's Global Sightholder Sales (GSS)[…]

Gem Diamonds finally sells its failed Botswana mine

The miner has sold Ghaghoo for a fraction of what it cost to build as it fails[…]