Chinese diamond companies will send large stones for polishing at a new manufacturing facility in Israel, the Middle East nation’s industry body said.

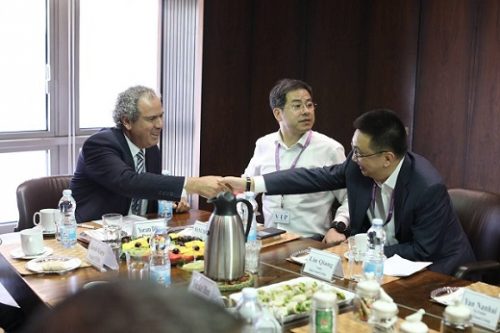

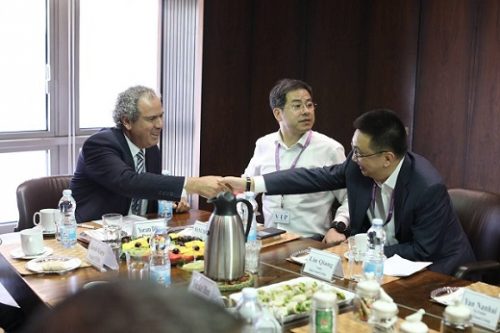

Bourses in the two countries reached the agreement this week during a visit to Israel by Lin Qiang, president of the Shanghai Diamond Exchange. The new factory is due to open in January at the next International Diamond Week in Israel.

The deal is part of a wider memorandum of understanding Qiang signed with Yoram Dvash, his counterpart at the Israel Diamond Exchange. Under that MoU, the two nations’ diamond industries will also make offices and other trading spaces available for each other to use, and allow joint participation in educational courses, the Israel Diamond Institute said Wednesday. Both sides will also help each other develop their diamond industries.

“This is a very unusual situation, whereby Chinese diamantaires will send their large diamonds to be polished in Israel,” Dvash said. “It is testimony to the well-known expertise of the Israeli polishers and the technological advances of the industry here.”

Israel’s polishing sector has dwindled as lower costs have helped India increase its market share. However, cutting of bigger diamonds has largely remained in Israel due to local expertise, the country’s industry leaders claim. The IDE and the IDI are investing more than $3 million in the new large-stone manufacturing plant in the Ramat Gan bourse complex in an attempt to reinvigorate its polishing trade.

It will feature two cutting centers, spanning 1,100 square meters, and will employ about 150 polishers. The organizations expect the factory to yield thousands of polished stones per year from 5 carats upward.

Source: diamonds.net

Two jewellers from India have broken the record of Most diamonds set in one ring, by setting a staggering 6,690 diamonds into an 18 karat rose gold structure, shaped like a lotus flower.

Vishal Agarwal and Khushbu Agarwal, both based in Surat, Gujarat, constructed the ring using a base component and 48 individual diamond encrusted petals.

The lotus ring weighs more than a golf ball, with a total weight of just over 58 grams.

It took six months to design and craft the intricate ring, which has been valued at $4,116,787 USD.

Vishal created the design for the ring, and Khushbu, who owns Hanumant Diamonds, funded and provided the resources for the ambitious project.

The ring was manufactured by Hanumant Diamonds artisans, based in Mahidarpura, Surat.

The lotus ring took the record from Savio Jewellery’s Peacock Ring which earned the record in 2015, with 3,827 cut diamonds.

The idea for Vishal and Khushbu’s creation came from them wanting to raise awareness about importance of water conservation.

They decided to use their work to generate awareness and settled on a lotus flower design because it is the national flower of India, and because it depicts “the beauty growing in the water-world”.

Anglo American’s De Beers the world’s largest rough diamond producer by value, sold $575 million worth of rough diamonds at the fifth sight of this year.

The value is a 6% increase from the $541m sight in the same period last year and 3.7% higher than the $554m sight last month.

De Beers has increased efforts in recent months to find a way to verify the source of diamonds and ensure they are not from conflict area where rough diamonds may have been used to finance violence.

Last month De beers announced it would start selling jewellery made with laboratory grown diamonds.

During the Intersessional Meeting of the Kimberley Process which took place from 18 to 22 June in Antwerp, the Central African Republic made substantial progress with the European Union Chair Hilde Hardeman and South Africa, Chair of the Working Group of the Monitoring Team, the CAR said in a statement.

Notably, the Monitoring Team of the Central African Republic has agreed on shorter clearance deadlines for the export of diamonds. The approval procedures in the CAR must now be concluded within 7 days while still securing compliance with the Kimberley Process.

Sipho Manese, Chair of the Working Group of the Monitoring Team, declared at the closing ceremony of the intersessional meeting: “We are happy to announce that thanks to the expertise of the CAR Monitoring Team and all of its members, we have been able to agree on procedures for the processing of shipments which will only take place over a period of 7 days. […] We were therefore successful in cutting down the clearance time from 2 weeks to 7 days.”

Manese further noted that all parties involved will have to strictly adhere to these procedures.

Leopold Mboli Fatran, CAR Minister of Mines and Geology attended the meeting as a representative of the sector for his country and said “I am very satisfied with the progress made at the intersessional meeting. The discussions were very fruitful and so were the solutions agreed upon.” The Minister added that “2018 is a crucial year for the Kimberley Process and for the Central African Republic as the country is at a deciding stage in the reform of its diamond sector.”

The CAR Delegation was reinforced by the presence of Peter Meeus, special advisor to the President and to the Minister of Geology and Mines, whose mandate is to assure proper due diligence processes within the CAR mining sector. This mandate was conferred to him with a presidential decree dated June 2, 2018.

The Minister of Mines and Geology also indicated his willingness to host an Expert Mission in the CAR so that the controls that have been put in place in the country in compliance with the Kimberley Process can be properly assessed.

The Central African Republic will continue to improve compliance with the Kimberley Process in close collaboration with the EU KP Chair, South Africa who leads the Monitoring Working Group as well as with the United States which leads the CAR Monitoring Team.

Source: idexonline

Trans Hex Group’s losses widened 2% to $13.9 million in the past fiscal year, reflecting the termination of its Lower Orange River mining operations.

The company halted production at the unprofitable LOR division in South Africa in October, and agreed in April to sell the assets to a firm called Lower Orange River Diamonds. Revenue from LOR fell 54% to $15.3 million due to the mines Baken and Bloeddrif being on care and maintenance for a large part of the financial year ending March 31. Losses at the discontinued operations grew 81% to $15.9 million from $8.7 million last year.

Sales at Trans Hex’s continuing operations West Coast Resources in South Africa and Somiluana in Angola more than doubled to $14.3 million . The miner recorded a $2 million profit at those assets, compared with a loss of $4.9 million a year ago.

Source: diamonds.net

De Beers public brand identity, has been renamed ”De Beers Jewellers” to reflect the companys retail chain.

De Beers acquired fully the formerly known De Beers Diamond Jewellers in 2017. Which was a partnership with LVMH Moët Hennessy Louis Vuitton.

The London headquartered retailer announced Stephen Lussier, as De Beers executive vice president for marketing in charge of the operation.

Lucara Diamonds have sold two exceptional large rough diamonds at the $32.5 million tender.

The tender included a 327 carat rough diamond that sold for over $10 million USD.

Lucara said the 10 stones ranging from 40.4 carats to a 472.37 carat rough stone a combined 1,453.06 carats, sold for an average price of $22,356 per carat.

The top seller was the 327.48 carat white diamond, which earned $30,900 per carat total $10.1 million.

Another exceptional size 472.37 carat light brown stone also sold but the miner has not publish its price.

Lucapa Diamonds said it had made USD $2 million after selling rough diamonds recovered at its prolific Lulo mine in Angola.

Sale has taken gross sales proceeds from the Angola based mine so far this year to $15.9 million.

Empresa Nacional de Diamantes and Rosas & Petalas, Lucapa all partners in th emine have sold 1,782 carats at an average price of $1,150 per carat.

The mine is located 150km from Alrosa’s Catoca mine the world’s fourth largest diamond mine, hosts type 2a diamonds which account for less than 1% of global supply.

Angola is now the world’s forth largest diamond producer by value and sixth by volume.

Shares in Petra Diamonds climbed around 5% on Wednesday after the South African miner said shareholders had approved a rights issue to raise about $170 million to help cut its debt burden.

Petra Diamonds has more than $600 million of debt it accumulated by building a new plant and digging deeper at its flagship Cullinan diamond mine.

Petra Diamonds is owner of the iconic Cullinan mine, where the world’s biggest ever diamond was found in 1905, has accumulated a hefty debt in the last 18 months as it borrowed heavily to expand its mines, known for some major recent findings,

Petra Diamonds has more than $600 million of debt it accumulated by building a new plant and digging deeper at Cullinan. Its lenders waived covenants for December 2017 and relaxed them for this year’s measurements.

Petra Diamonds also faced illegal mining at its operations, weak prices, a surging South African rand and setbacks in Tanzania, where the government seized last year a diamond parcel from it Williamson mine of about 71,000 carats. The move, part of the country’s ongoing probe into alleged wrongdoing in the diamond and tanzanite sectors, has been costly for Petra, as it shares lost around half of their value last year after the incident.

The exceptional 20.47 carat D colour type IIa old mine brilliant cut, diamond has sold for USD $2.7 million.

The D flawless diamond was the top seller at Christie’s Magnificent Jewels auction in New York on Tuesday.

The Christie’s pre-sale estimate for the diamond was $2.5 million to $3.5 million.