More than 110,000 Western Australian couples have celebrated a special occasion featuring a piece of Rosendorff’s fine jewellery.

An announcement to the Australian Securities and Investments Commission (ASIC) said a meeting of creditors was set to get under way at 11am Thursday.

Richard Tucker of KordaMentha Restructuring, appointed receivers and managers of Rosendorff Diamond Jewellers, said the business was holding too much stock.

“We are running a short highly discounted sale through the store to materially reduce the current stock levels whilst a sale or recapitalisation of the business is pursued,” Mr Tucker said.

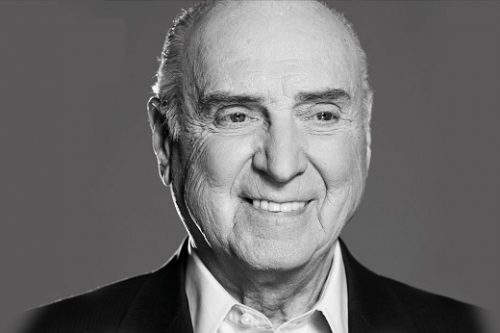

I have always loved the mystique of diamonds. I’m attracted to the joy and romance they bring to their beholders

Craig Rosendorff

“It is a tremendous opportunity to acquire a very special jewellery item at very competitive prices and may also help save an iconic Perth jeweller.”

He said a secured creditor would support the receivers to ensure current special orders, repairs and lay-bys were completed in time for the special occasions they might be destined for.

“From proposals, to weddings and anniversaries, we understand the importance and significance these items have on people’s special memories,” Mr Tucker said.

Daniel Hillston Woodhouse of FTI Consulting has been appointed as administrator.

Rosendorff is an iconic West Australian luxury business specialising in diamonds and bespoke jewellery design headed by Craig Rosendorff.

In 1975 Mr Rosendorff renamed and launched what became one of the longest-standing diamond companies in Australia.

His rags to riches story has been dubbed The Diamond Dream.

“I have always loved the mystique of diamonds,” he says on the company’s website.

“I’m attracted to the joy and romance they bring to their beholders, the heritage and their connection to families across generations.”

The large, glamorous showroom in the centre of Perth on Hay Street has been the setting of many magnificent parties and events showcasing the designs of the Rosendorff team.

Mr Tucker said gift cards and store credits would be honoured while trade continues.

Source: watoday.com.au

White knight rescues collapased Rosendorff Diamond Jewellers

The Rosendorff fine jewellery business will carry on but under new ownership following a deal struck by receivers appointed last month.

Insolvency firm KordaMentha confirmed today it had struck an agreement to sell the business set up by Craig Rosendorff in the 1980s to an unidentified WA buyer also involved in the jewellery trade.

The deal, expected to be finalised in two to three weeks, guarantees more than 20 jobs and covers the Rosendorff trading name, stock and intellectual property.

Receivers from KordaMentha were put into Rosendorff Diamond Jewellers at the end of April.

The business, which owes at least $4 million to creditors, has shrunk on falling sales in the past three years to just its flagship store in Hay Street Mall.

The deal covers the Rosendorff trading name, stock and intellectual property.

Today’s sale announcement coincided with news the receivers are stepping up a discount sale which has already brought in between $2 million and $3 million.

The West Australian revealed yesterday that administrators from FTI Consulting had identified “irregularities” in the company’s accounts while sheeting home blame for the collapse to the mining downturn.

They questioned a $1.8 million shortfall in stock and four transactions totalling $170,000 where jewellery “left the store without payment”.

FTI said “there were limited controls around the accounting and inventory functions, which have led to some anomalies in the financial accounts”.

However, it noted that such irregularities were not uncommon, and there is no suggestion of any wrongdoing by Mr Rosendorff.

The firm’s statutory report on Rosendorffs also noted that Mr Rosendorff, who has invested millions of dollars in the business over the past 30 years, had drawn increasing amounts out of the company as its financial situation deteriorated.

Between July 2017 and FTI’s appointment, those withdrawals totalled $1.8 million, including $582,000 in the past 10 months.

The administrators says Rosendorffs had been under financial pressure for two years, citing “cash leakage” and a steady decline in sales after 2011, triggered by the end of the mining boom.

Gordon Brothers is owed about $2.2 million, Rosendorffs’ staff $400,000 and trade creditors $270,000.

Source: perthnow.com.au