Diamond miners are feeling the pressure after a funding crunch in the world’s polishing hub dented sales of rough gemstones.

Since celebrity jeweller Nirav Modi fled India in 2018 accused of having defrauded a state bank of nearly $2bn, banks have sharply cut back lending to diamantaires, who cut, polish and trade the world’s diamonds.

“Bankers have blacklisted the jewellers industry,” said Shantibhai Patel, president of the Indian Bullion and Jewellers Association in Gujarat, the country’s diamond-cutting centre.

The squeeze has forced diamantaires to buy less from diamond producers such as De Beers, Rio Tinto and Gem Diamonds — which have seen sales and margins suffer as a result.

De Beers is on course to report its worst annual sales in at least four years. In response, the world’s largest producer reduced prices for its rough diamonds by 5 per cent last month at its November sale, the biggest discount in years, Bloomberg reported. De Beers declined to comment on its pricing.

Across the sector, rough diamond prices have fallen 15 per cent since last November, according to Polished Prices. Industry experts say a further 10-15 per cent drop would push some smaller producers to file for bankruptcy.

“It’s a liquidity crisis that’s affecting the middle of the pipeline,” said Edward Sterck, an analyst at BMO Capital Markets. “Diamond manufacturers can’t afford to pay rough diamond prices . . . It’s a function of necessity that prices have come down.”

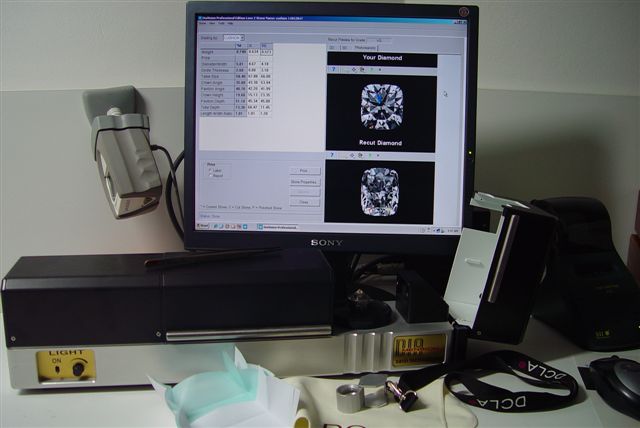

Diamantaires — 90 per cent of which are based in India — buy rough diamonds from producers such as De Beers that they then cut with lasers and polish for use in jewellery.

The flight of Mr Modi, whose clients included actress Kate Winslet, prompted banks to tighten up lending terms for manufacturers. Bank credit to the diamond industry, of which Indian companies receive about four-fifths, fell 20 per cent to $8bn this year, according to WWW International Diamond Consultants.

As a result, diamond cutters are working through existing stocks rather than buying on the global market. According to India’s Gem and Jewellery Export Promotion Council, imports of rough diamonds into the country fell 22 per cent year over year to $7.3bn between April and October.

This has struck diamond mining companies hard. Stuart Brown, chief executive at Toronto-based Mountain Province Diamonds, said the rough stone market was “challenging” in its third-quarter results.

Mid-sized producers including Canada’s Lucara Diamond and the UK’s Petra Diamonds all reported lower prices for their diamonds in the latest quarter. Lucara reported a selling price of $390 a carat, a 13 per cent drop from last year and a steep fall from 2014, when gems sold for $644 a carat. Dire market conditions drove Quebec-based Stornoway Diamond into bankruptcy in September.

The diamond industry differs from other commodities given the large influence of the two largest producers on pricing, and the fact that diamonds vary in size, quality and colour. De Beers is a “price setter” that offers uncut stones to traders for fixed prices and quantities at sales, known as “sights”.

Production cuts and concessions, including discounts and flexibility to return stones, have provided some relief to De Beers and its customers. Sales rose last month but were still below $400m — the lowest in a November sight on record.

Mr Patel welcomed the Anglo American-owned company’s price cut, but expected little uplift in the foreseeable future. “There’s no work,” he said. “For one year, one and a half years, we’re not expecting any bullish trends.”

But Colin Shah, managing director of manufacturer Kama Schachter, is hopeful that the worst was over for diamantaires. He said that manufacturers were adjusting to the tougher norms in place after the Modi scandal, which could get liquidity flowing again.

“There’s much more [scrutiny] than there used to be,” he said, referring to banks’ lending practices. “Inventories have come down, everyone has made their business models leaner . . . I think the second half of 2020 will be better.”

Industry executives point to tightening supply over the next few years that will help restore diamonds’ key feature: rarity. Rio Tinto’s Argyle mine, which outputs 90 per cent of the world’s valuable pink diamonds, is set to close next year.

Meanwhile, retail demand for diamonds has been robust, particularly in the US where spending on diamond jewellery grew 4.5 per cent to $36bn last year. French luxury group LVMH’s $16.6bn acquisition of Tiffany, agreed last week, was seen by analysts as a vote of confidence in long-term consumer demand for diamond jewellery.

But other industry figures say more drastic action by diamond mining companies is needed to help bedraggled manufacturers. Martin Rapaport, founder of the world’s largest diamond trading platform, said the price cut was insufficient. “It’s not enough to recapitalise the industry,” he said.

“They need to drop prices as much as 50 per cent to return liquidity to the market. It’s too little too late.”

Source: ft.com