India’s government is being urged to adopt the same rules on lab grown terminology as the US.

The GJEPC (Gem & Jewellery Export Promotion Council) says its 7,000-plus members are now required to adhere to the rules introduced by the US Federal Trade Commission (FTC) in 2016 and amended two years later. They have also been adopted by many other countries.

“Since India’s gem and jewellery trade has unanimously accepted the FTC’s new definition with respect to diamonds, we urge the Indian government and ministries to accept, adopt and adapt the same to existing consumer laws of our country.”

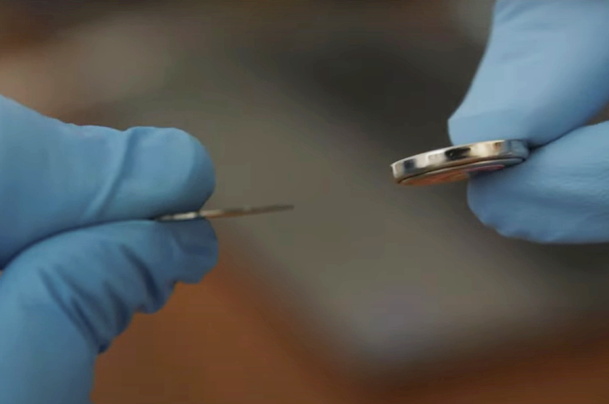

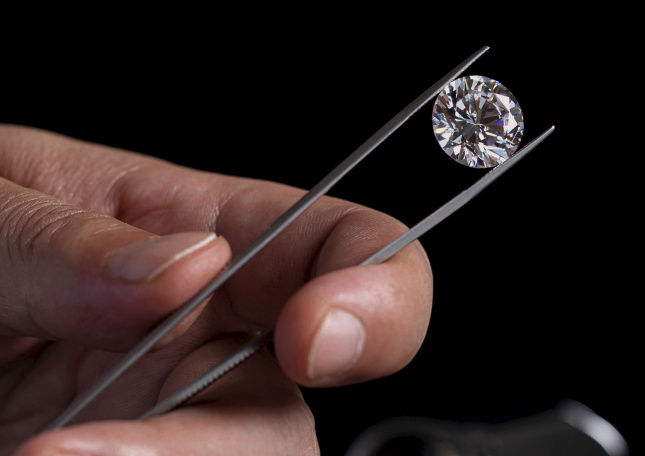

The FTC provides detailed guidance on exactly what forms of words can be used. It says: “If you sell laboratory-created diamonds, you should tell consumers that they are not mined diamonds by describing them as “laboratory-grown,” “laboratory-created,” “[manufacturer name]-created,” or some other word or phrase of like meaning so as to disclose, immediately preceding the word “diamond” and equally conspicuously, the nature of the product and the fact it is not a mined diamond.”

Smit Patel, convener of the GJEPC’s lab-grown diamond panel, said: “We have urged the government to align with the advancements and economic significance of lab-grown diamonds by adopting a forward-looking policy framework.”

The Indian government says its Central Consumer Protection Authority (CCPA) has organized a stakeholder consultation on consumer protection for the diamond sector, following representations from the GJEPC.

Source: Idex