Tiffany & Co. Honours Jean Schlumberger’s Legacy with the Launch of the Enamel Watch

Tiffany & Co. Honours Jean Schlumberger’s Legacy with the Launch of the Enamel Watch

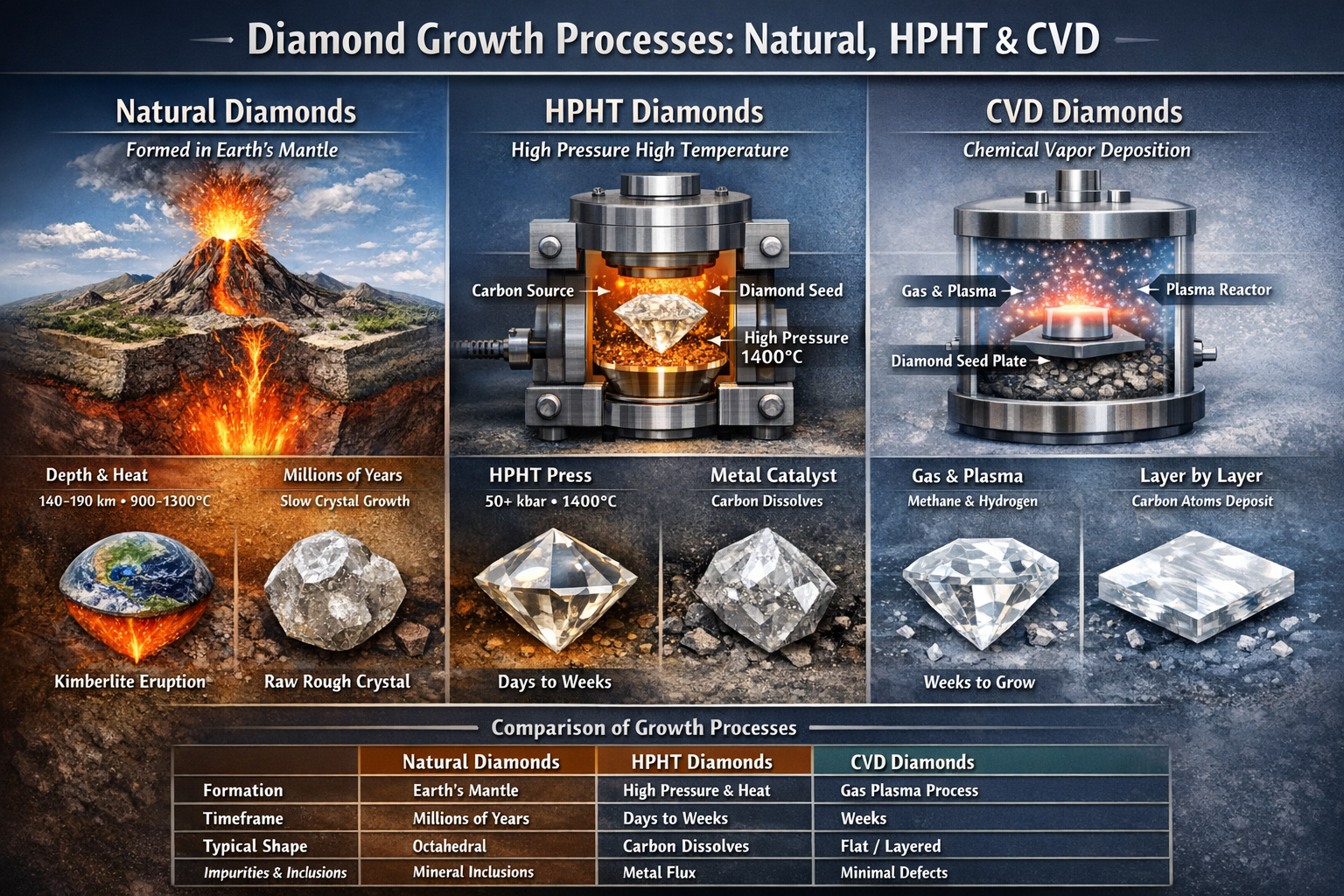

Understanding Diamond Rough Growth for Natural, HPHT and CVD Diamonds

Naturalmined, HPHT, and CVD Rough Diamonds

Pandora Opts for Platinum Plated Jewelry as Silver Prices Surge

Pandora is introducing platinum-plated jewelry to reduce its reliance on sterling silver, after silver prices more than[…]

Historic Crown of Empress Eugénie to Be Restored After Louvre Heist

The Louvre Museum has released striking images of a historic crown once worn by Empress Eugénie, following[…]

Anglo flags third De Beers writedown as Teck merger looms

Anglo American is weighing a third writedown of De Beers in as many years as weak diamond[…]

IDEX Price Report: Further Drops for Rounds and Fancies

Price drops dominated yet again both for rounds and fancies during January, as US tariffs on India[…]

Gems set to retain sheen, view cloudy for diamonds after US tariff cut

Washington's reciprocal tariff reduction is expected to help India's gems and jewellery exporters regain lost ground in[…]

How to Design a Bespoke Ring: A Professional Guide to Craftsmanship and Diamond Selection

Designing a bespoke ring allows for complete creative control and ensures the finished piece meets the highest[…]

Justin and Hailey Bieber Return to the Grammys Draped in Over 160 Carats of Diamonds

Justin and Hailey Bieber made a dazzling return to the Grammy Awards in 2026, stepping onto the[…]

The Apollo and Artemis Diamonds: The Most Expensive Pair of Diamond Earrings Ever Sold

The Apollo and Artemis diamonds stand among the rarest gemstones ever discovered—extraordinary not only for their individual[…]